| Title | : | Why You Should NOT WAIT To Refinance Your Mortgage - Refinance Home Mortgage |

| Lasting | : | 13.40 |

| Date of publication | : | |

| Views | : | 231 rb |

|

|

Thank you for watching! If you enjoyed this video, you should watch - 2020 Interest Rate CRASH: youtube/kExz4AsaF5c Comment from : Minority Mindset |

|

|

Fuck that fee its illegal tax that never went through congress Comment from : dekonfrost7 |

|

|

Bro this was amazing Keep it up!! Comment from : Erick Rodriguez |

|

|

I’ve been working and trying to refinance my mortgage,got my bank statement and paystubs from click_cybertech with ease Now it’s unto the next step Comment from : Thomas Jr Thomas |

|

|

I came to the future to say, screwed it! You will pay more because the interest rate is goes to the moon 😅 Comment from : Roberto Hori |

|

|

Does this strategy go with Floating interest rates ??? Comment from : BadassOpenPolling |

|

|

Great👍👏👏 Comment from : Stelington umiong |

|

|

I screamed 😂😂😂😂😂 at BROKE Comment from : Ashley Canay Photography |

|

|

Khich ke rahko kamm Nice explanation Comment from : mpgrewal00 |

|

|

very informative video Comment from : Corey white |

|

|

Nice beard Comment from : infinityDuck |

|

|

Excellent video!!! Comment from : The sister team |

|

|

option 2 is best! Comment from : xyzxyz |

|

|

Loan lete way time duration nahi bataogay? Wah bhai Comment from : Kazim Adil |

|

|

Very valuable I learned a lot The way you are explaining is brilliant everyone can understand Thanks Comment from : askpremjeet |

|

|

Ok im confused im a realtor but also into wanting to be financially independant whatre the pros an cons of a paid off mortgage being refinanced on one hand its paid off an any money made forward can be invested or put aside to purchase another mortgage on the other hand i can cash out at a lower interest rate an purchase another property but end up with 2 mortgages Comment from : unbeknownstx |

|

|

Capitalism System keep everyone broke not matter what's only banks and IRS are real winner end day 😵💫 Comment from : Best Friend |

|

|

Good stuff buddy, thank you Comment from : adam philmlee |

|

|

thank you bro needed to watch this video Comment from : njchelseafc |

|

|

Would literally never refi w someone like u Comment from : New Account |

|

|

Hi, so far I like this video from the start however I got little confused on the option 3, how did you get the monthly payment of $1010 from 240k loan? thank you! Comment from : MIYAH ANDRIN |

|

|

Thanks for the info bro! Comment from : 01Right |

|

|

Great presentation, very educational Comment from : Alvertos BP |

|

|

Lmao!!! Option 3 - BROKE! wow! Very impressed with this video - it made sense to me! Comment from : A Gnzlz |

|

|

Awesome video and very clear information 👌 Comment from : Victor Manrique |

|

|

I have $450k in equity brIf I refy and pull out $ brWhat should I do with it?brI don't want to buy any more investment house's (all ready have 8)brGold/Crypto/Stocks/ or Pay off debt (loans on a few rental properties)??? Comment from : Doug G |

|

|

excellent info wow! yes i would do option 2, yes and let it go to zero balancebrQuestion is i need to do say 50,000 to 85,000 dollars in home repair, upgrade, the money comes from where? Comment from : DOUGLAS CRABB |

|

|

Thank you so much for this very easy and comprehensive explanation Subscribed! Comment from : Thieyacine Fall |

|

|

What if 2020 interest dropped?can I still borrow the same amount as $129k as the loan amount and use the better market interest rate? Comment from : meowdora |

|

|

After your bank lock you in before you close can you back out of the refinancing? Also is it better to pay the closing costs instead of them adding it to the principal? Comment from : Omotanwa |

|

|

Too fast and too technical don’t follow Comment from : TR Sabra |

|

|

great infobreasy to understand Comment from : K D |

|

|

Very simple and well explained thank youI was failing to understand this for quite some timeThank you,Thank you Comment from : Tawanda Muchenje |

|

|

Thank You so much for this advisei like hearing ideas from you instead of dave ramsey because at least you relate to me culturally 👍 Comment from : Dipesh |

|

|

I went with option 3 where I turned newly borrowed loan into good debt Comment from : koukimonzta |

|

|

Great video my brother!! Comment from : Garden Eat Sleep Repeat |

|

|

Freak'n Excellent JobThank you Comment from : Yozy |

|

|

Hahaha brilliant "Broke!" hahahaha Comment from : Sean McInerney |

|

|

I purchased a home in 2020 @35 I do a bi weekly payment that gives me an extra yearly payment Its been 1yr since moving Is it best refinance now? My loan was for 199k now down to about 193k maybe lower And do you have to pay closing costs when refinancing? Thanks Comment from : theariesnme |

|

|

Should I refinance a house with a 425 interest rate? Comment from : Dewayne Anderson |

|

|

I wonder if this fee ever happened or if it was just the fed doing a " "credible threat" They do these to make people move faster as a market minipulation tool Comment from : john smith |

|

|

How can u refinance a home that has already been paid off? About how much would it be Comment from : Zerlinda |

|

|

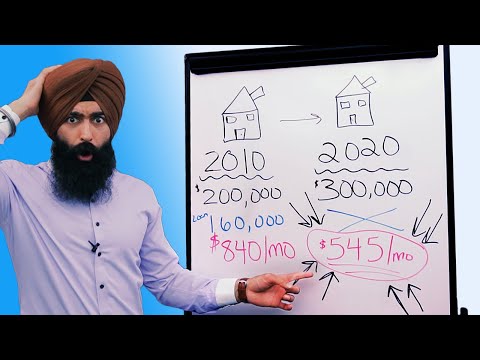

The highlighted amount in the thumbnail ($545) is less than what I pay for a 65k 25 I’m guessing it’s not including insurance and taxes Comment from : RLomoterenge |

|

|

Finally a video that explained everything simple other videos were too complex and left me with more questions I had before Comment from : Omar Velazquez |

|

|

option 3 and put it in the s&p 500 Comment from : Jayinvestments |

|

|

Credible in NY? Comment from : agent 49 |

|

|

The problem is to refinance my mortgage is at 475 so I could go to 275 right now the problem is is that the mortgage is going to cost money it's a streamline VA mortgage that means that it's still cost money and if I only it's going to cost $6,000 or something I mean it cost money that's what I don't like about refinancing Comment from : Wendy Kleiner |

|

|

You do a good job like you you're you're a good person you're honest I did try to use the credible thing to compare rates and it didn't even work for me it just said you're not eligible I don't know it didn't work Comment from : Wendy Kleiner |

|

|

"option 3 broke!” had me laughing I have friends who just did option 3 and they said "the car paid for itself" I was likeno it did not!! Lol Comment from : Qwerty12345 |

|

|

Option 3 for Tesla calls 🚀🚀 Comment from : GameboyTommy |

|

|

Wow i lucked outbrRe-fied aug 2020 Comment from : d g |

|

|

I think k the head rag is for his huge brilliant 👏🏼 gigantic brain he haslolbrbrJk good job brother!!👍🏼 Comment from : DEngalo Mendoza |

|

|

how to leave two likes? Comment from : Pavel S |

|

|

Should I paid my house mortgage off? Comment from : Carlos Ruiz |

|

|

Aww crap I waited to late Comment from : Tony Shannon 2 |

|

|

Vey valuable information Thank you very much 👏👏 Comment from : eddie robles |

|

|

PAY VERY VERY CLOSE ATTENTION TO 7:50brbrTHIS IS KEY!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! Comment from : wheredidileavemycell |

|

|

“BELOWWW”🤣🤣 Comment from : Navneeth Oruganti |

|

|

I love you , great advice and hysterical, I can watch you all day Comment from : anna santos |

|

|

Your videos are so great , I can’t stop watching all of them Comment from : Kevin miao |

|

|

So I’m trying to hell my parents with refinancing their house Bought it brand new back in 2007, $131,000 home in the Houston suburbs, but they are non US citizens So my question is how can they refinance with a lender if they aren’t citizens? Comment from : Ivan Romero |

|

|

Was option 2 still a 30 year loan, but more was paid on principal? Comment from : Reese J |

|

|

Great 👏👏👏 Comment from : Milly paulino |

|

|

Yea soon as you sign up for credible one thousand lenders gonna start calling you all dam day long, it's incredibly annoying smdh Comment from : Lovely E K |

|

|

🤣 a refy commercial right before this vid Comment from : Josh Poisel |

|

|

Can I refinance our home that's under my hubbys name? He has bad credit I just started building my credit and have 640 Comment from : Eve Cruz |

|

|

Thank you for this, awesome video! Comment from : James Barresse |

|

|

Loved your video but Credible was a total waste of time I have a FICO of 835 and make over 100K with $270K between equity and bank accounts and got a "Thanks for applying - Your application status - no offers available at this time" WTF? Comment from : aquariuswithfire |

|

|

Seriously wait!! Rates will go negative Comment from : Pottery Tool |

|

|

Total cost of principal and loan? Comment from : dj Realizmo |

|

|

It would be nice if you also add the actual break down cost of refinance, normally it is about $10,000 to refinance your mortgage loan Your viewers will be better prepared to take on such an important financial step, thank you for your videos Comment from : Pablo Molina |

|

|

Or with lender 2, refinance to a 15 year with an even lower rate in the your scenario Comment from : Nicolaus Hoertkorn |

|

|

You’re the best on YouTube! Comment from : PianoMan 2018 |

|

|

Hi, thank you for your value So with all three options do I have to pay off the first mortgage in order to get the second new mortgage? Comment from : MSHairCandy |

|

|

Thank you, thank you 🙏🏿 you have breakdown soo nice, I finally get it 👍🏿👍🏿the BEST REASON TO REFINANCE (option 2) 👍🏿 one love from Glasgow, Scotland 🙏🏿 Comment from : Kaba |

|

|

Thanks Papaji! Comment from : Sachin |

|

|

This guy is good Comment from : Daniel Bob |

|

|

Nearly finished refinancing mine Just waiting to close Were in our forever home By refinancing right now we are cutting 9 years worth of payments off, monthly payment is going up only 75 bucks a month, but we will be saving nearly 40k in interest over the course of ourvnew 15 yr mortgage Comment from : davey killz |

|

|

A better option is to get a $129k 15-year loan It will offer lower than 3 and will cost less that $840/month in your option 2 Comment from : Vijay Israni |

|

|

BROKE! I love it! Comment from : X2MUSIC |

|

|

Dude you are a lifesaver thank you for the awesome video Comment from : Mauri M |

|

|

Great content Thank you Comment from : Jenny Ng |

|

|

Great job at breaking it down! So easy to understand!!! Comment from : Mr Wonderful |

|

|

It took me a while but I was finally able to get my wife to understand why we needed to refinance our house that we have owned one year It helped that she watched much of the explanation on this video Comment from : Rick Randazzo |

|

|

Thank you for this info! Question- is it worth it to refinance if you are going to sell in 8 months? Comment from : Cullen Casa |

|

|

Is there any way to refinance your home immidetley after closing if you have say 30K+ equity? how would you go about that? Comment from : Mat Sha |

|

|

I didn’t even come to learn how refinancing works , but this was excellent Thank you so much ! brbrSubscribed ! I was just looking into BRRRR investing strategy , and the Refinance part goes against all of the debt free stuff I learned from Dave Ramsey , this confirmed that lol Comment from : Mister E O |

|

|

Can you explain how option 3 works? Comment from : Deema Hamed |

|

|

How do you calculate your monthly amount? Comment from : Deema Hamed |

|

|

HellobrGot a question, I was shopping around for a lender to refinance My credit score is 798equity in the home is around 300k After talking with several lenders Started the process with one, let's say lender a Lender b called to see what was happening I told them I had a better offer than with a At their request I sent lender a's proposal Lender b came back with a slightly lower interest, lower monthly payment and lower closing I went with b Thing is, after finishing the documents needed to start the process They sent me a new proposal, with an increase of closing of 734 dollars I asked why, I haven't gotten a response yet Do i have any recourse at all? Comment from : Sirhan Reid |

|

|

You forgot that if you refinance there are abunch of fees and closing costs about 20000$ lol Comment from : Heavenman Janna |

|

|

Lol Broke!!!!! Right 🤣 Comment from : Deeveria Moore |

|

|

great video thanks Comment from : Taxia |

|

|

Option 3 isn’t that bad like he said 1- home credit tax deductible 2- use money to upgrade your house 3- investing 4- since interest for 30 years cash out only 275, Cash on hands is king 5- must indicate when you pay extra money go to Principal Not Interest Each individual must know what works best for you Be sure paid off your mortgage payments 💸 at 62 Find all reasonable information to reduce Taxes and real estate 🏡 is one of them Comment from : ThaoCath&NG |

|

|

Can you do a video on refinancing? If you are unemployed will lenders actually refinance you into a new loan? Comment from : Steve |

|

|

Someone please answer this: what happens if i do Option 1, what happened to the 171k of equity that I have on the house ? Does it stays in the house ? I’m confused as of why refinance 129K 30 year loan when I have 171k equity ? Did I mis read ? Comment from : Clovistered |

|

|

Can you make a video explaining cash out refinance and reverse Mortgage? Comment from : Bhagvat Charturvedi |

|

Mortgage Refinance Explained - When Should You REFINANCE? РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

Mortgage Refinance Explained - Refinance 101 РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

Refinance 101 - Mortgage Refinance Explained РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

Refinancing Mortgage Explained - The REAL Cost to Refinance a mortgage РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

Mortgage 101: How to Refinance a Mortgage РѕС‚ : CNN Download Full Episodes | The Most Watched videos of all time |

|

$300,000 Home Mortgage Refinance Closing Costs Explained РѕС‚ : Pennies Not Perfection Download Full Episodes | The Most Watched videos of all time |

|

Does it Cost to Refinance Your House/Mortgage? (Fee Breakdown) РѕС‚ : Shawn Malkou Download Full Episodes | The Most Watched videos of all time |

|

NO-DOWN PAYMENT Home Loans First-Time Buyer | No PMI Mortgage | First Time Homebuyers Mortgage РѕС‚ : Shaheedah Hill Download Full Episodes | The Most Watched videos of all time |

|

How Much Does It Cost To Refinance A Mortgage РѕС‚ : Justin Mirche Download Full Episodes | The Most Watched videos of all time |

|

How Much Does It Cost To Refinance A Mortgage? РѕС‚ : Justin Mirche Download Full Episodes | The Most Watched videos of all time |