| Title | : | $300,000 Home Mortgage Refinance Closing Costs Explained |

| Lasting | : | 10.59 |

| Date of publication | : | |

| Views | : | 8,7 rb |

|

|

i have property sold to 501th closing is april 21,2022 ,but my private lender force us to pay off remaining balance on april 5,2022, told pay him on april 21,2022 , what will we do ,can not find financing Comment from : manuel david |

|

|

If I Bought A Home For $230,000 Value At The Time Of Purchase And Now The Home Is Currently Valued At $380,000 Will Refinancing Get Rid Of My PMI Cause Of The Home Value Increase? Thank You In Advance I Have Been Paying My Home For 4 Years Now As Well Comment from : v |

|

|

Why was your rate so low??? Was there a down payment and points included? Comment from : Margeaux Jenkins |

|

|

Your closing cost is ok To me, but last week I tried to refinance my home, brI was shockeing and disgusting by the closing costs, brMy mortgage was $124,000 , after refinancing it went up to $147,000 , I asked the loan officer, did it really cost 23k to refinance a home? She said yes brAnd I left with no word, she contacted me the next day, we have a few word, but nothing changes, not worth it Comment from : KoVamp |

|

|

Still an excellent time to refibrGreat videobr2 things jump outbrThe origination charges are too high and the fees are too high You can get origination for as low as $250 with same rate or betterbrAlso they had an appraisal waiver which is commongood example here Comment from : Money Talks with Jonathan Thomas |

|

|

We bought our first home and got amazing interest rate of about 21 Comment from : Hiru in the USA |

|

|

225 baby! Comment from : Cassidi Roberts |

|

|

Hello! I found you on Freakin Frugal! I am loving your mortgage advice! ❤👍🤗 Comment from : Dumpster Diving Moe |

|

|

Dang for those closing cost you should have gotten 25 rate Loan cost (section D) should have been no more than 2k at par rate :/ Comment from : Néstor J Caussade (Russell) |

|

|

Intetest is more "upfront" because the debt is higherthe sooner the principle is paid down the sooner the interest becomes lower I always thought it was some weird math trick but its literally only higher because its the interest rate on the balance over the life of the mortgage, so when you pay the balance down the interest becomes lower I cabt believe how long i disbt know that for Comment from : T |

|

|

Great information as always 😃 Comment from : Holo Holo Adventures |

|

|

We have the option here to change variable loans to a fixed loan for up to 5 years, but the best interest rates this past year was for the 4 year So we switched and went from 44 to 189 Only catch is we cannot pay more than $30,000 extra to the mortgage in that time frame, so we will do up to that and call it good All it took was a phone call - no paperwork, no costs, easy peasy Looking at saving over $20k in interest In four years it will revert back to variable and the current rate, but we can switch back to fixed at any time Long term fixed rates are extremely rare to find, everything is variable Comment from : Erin Budgets Aimlessly |

|

|

What a great break down Comment from : eSusan12 |

|

|

This is super helpful I'm in the middle of refinancing and didn't know what some of this stuff meant Thank you for explaining it! Comment from : Cami Suire |

|

|

I just refinanced! 375 to 2375, 30 year to 15 year, and dropped PMI! 10 years off the original loan, since I’ve been in my house for 5 years I’m not sure if I’ll be here for many many years, but it feels so good for right now! I now have $800 a month going to principle rather than $360 and my payments are lower! Comment from : Kari Brantner |

|

|

We refinanced in the fall of 2020 and so glad we did It’ll save us so much on interest! Comment from : Dear Debt |

|

|

I just closed on my refi this morning! 30 to 15 year, dropped 12 points and shaved off 11 years I am so thankful for your videos about refinancing It actually pushed me to do the same :) Comment from : hayhayhay |

|

|

Mary making a difference by providing helpful information & highlighting saving money on the big stuff 👏 Comment from : Sandra from Scotland |

|

|

Did they have to pay the $8k or the $900 when they refinanced? I'm new to all this I'm currently in a HUD loan And looking into refinance but not sure how much I money I would need to refinance Thanks 😊 Comment from : T Jay |

|

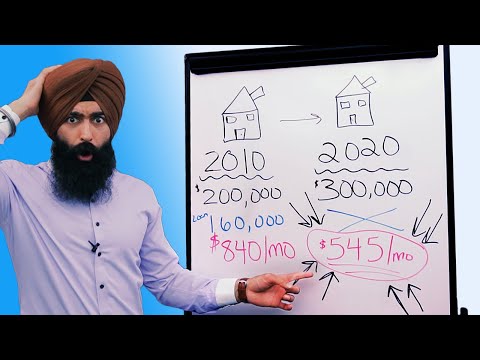

Why You Should NOT WAIT To Refinance Your Mortgage - Refinance Home Mortgage РѕС‚ : Minority Mindset Download Full Episodes | The Most Watched videos of all time |

|

Mortgage Refinance Explained - Refinance 101 РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

Mortgage Refinance Explained - When Should You REFINANCE? РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

Refinance 101 - Mortgage Refinance Explained РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

Refinancing Mortgage Explained - The REAL Cost to Refinance a mortgage РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

What Are Refinance Closing Costs? | LowerMyBills РѕС‚ : LowerMyBills Download Full Episodes | The Most Watched videos of all time |

|

Mortgage 101: How to Refinance a Mortgage РѕС‚ : CNN Download Full Episodes | The Most Watched videos of all time |

|

How to Buy a Home With No Down Payment u0026 No Closing Costs, The NACA Program Explained РѕС‚ : Earn Your Leisure Download Full Episodes | The Most Watched videos of all time |

|

Home Buying - Can my parents gift the down payment and the seller pay the closing costs? РѕС‚ : KNOXCOUNTYOHIOcom Download Full Episodes | The Most Watched videos of all time |

|

NO-DOWN PAYMENT Home Loans First-Time Buyer | No PMI Mortgage | First Time Homebuyers Mortgage РѕС‚ : Shaheedah Hill Download Full Episodes | The Most Watched videos of all time |