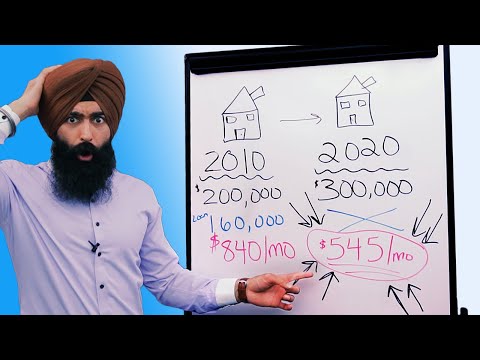

| Title | : | How to pay off a 30 year home mortgage in 5-7 years |

| Lasting | : | 29.13 |

| Date of publication | : | |

| Views | : | 6,5 jt |

|

|

Pay half of your mortgage every 2 weeks This equals ONE extra payment per year This one simple thing will pay off a 30 year mortgage in 23 years… Comment from : Wallace Dunn |

|

|

My point exactly Comment from : Marie Heiple |

|

|

This is only factoring in mortgage and interest and assuming the down payment was 20 of $40k up front Comment from : Mama Mack |

|

|

Her math is flawed!! She is not including the taxes, PEIM, mortgage insurance, HOA, flood insurance, etc this is a good idea but doesn’t mathematically work! 😅 Comment from : Mama Mack |

|

|

Great info!!! Thank you for this video Comment from : teressa velez |

|

|

Only fans 😅 Comment from : I_Luv_Bootyful_Women |

|

|

Nice stove Perfect for a 15 x 20' den Nice heat throw A blower helps It's Sold separately Comment from : hina anih |

|

|

Be born beautiful and start a YouTube channel Comment from : Will Mitchell |

|

|

Thank you Comment from : Grayson Gutzweiler |

|

|

Paid off all debt in seven years, including $91,000 mortgage YOU CAN DO THIS All you have to do is make a realistic monthly budget with attainable quarterly goals Comment from : Jay Walk |

|

|

I watched this forever ago and the premise is correct But these numbers aren't realistic My mortgage with escrow is 1200 and I paid 100k for the house Someone making 60k a year does not keep 5k each month, lucky to keep 2500 each month If u have a 600 dollar car payment, sell it immediately u fool Comment from : L6901Malice |

|

|

I will forever be indebted to you you've changed my whole life continue to preach about your name for the world to hear you've saved me from a huge financial debt with just little investment, thanks so much Mrs Payton Brooks Comment from : David Walker |

|

|

Laura - I know I am watching this v late and I get your point but one critical detail you missed was the 21 interest -175 per month is going to to do to the account balance In addition you only paid the $12K off in this case so you can't compare the $200K of home loan at 6 with $12K of CC dept If you of have a LoC with 21 with a $300K limit and used that to pay mortgage I don't think this method will work unless you have large savings to reduce the $200K down In that case you may as well apply to the original loan and reduce the payment period As a backup for emergency take out a HELOC but don't use it until you need to! This will work well if your mortgage rate is close to the HELOC rate Comment from : prasad vindla |

|

|

I wouldn't touch this method with a ten foot pole unless I had a rock solid understanding of how inflation and higher FED rates might effect me Comment from : B-McG |

|

|

30 mins and I still don’t get it?? Comment from : LJR Rose |

|

|

Velocity banking Comment from : Daniel Willover |

|

|

Re dick a lus Comment from : Big Dog |

|

|

I love seeing young people talking about the basic responsibilities of being a grown up Good job Laura Comment from : Alcides Gutierrez |

|

|

Great presentation Laura thanks for sharing (: Comment from : Liza Grace |

|

|

Great video but i wished you was more detailing about it about line of credit and how to add it Comment from : mqmoreno23 |

|

|

She neglected the interest the LOC will accrue daily at 21 apr Will take longer than 6 months to pay the 12k Comment from : terri |

|

|

Can you help me to set up this strategy in my house? Comment from : JUAN JOAQUIN |

|

|

Genius implementing this Laura Comment from : Debra Warner |

|

|

Hello Laura may you do an updated video if this? Just the numbers are so crazy now and yet were not making much more money in our salary ❤ Comment from : mdh |

|

|

Do you know of a free spreadsheet where I could apply the numbers for paying off the credit card using this method? I've been looking!! Comment from : Ecolocal Farms |

|

|

Very interesting conceptI make 62k a year but my bring home pay is 3,500 after taxes etc from check Comment from : Colleen Kay |

|

|

Do you pay for your monthly expenses on credit? Comment from : timothy madaras |

|

|

Do you go to your bank for a line of credit or any bank? Comment from : timothy madaras |

|

|

I have a way too pay off your mortgage in one day, interested simple, just pay the multi thousands you owe at one time, same day ! See I Told you a sure fired way to pay off in one day Now send me 1 of loan for this correct advice Comment from : Opinion counts |

|

|

Wouldn putting all the savings+LE towards CC be the same without have to pay the extra CC interest? Are you using the interest free loan for 30 days CC payment plan? Just pay the Mortgage,car straight from bank What about making mortgage payment and write a 2nd check for the following 1,2,3 months principle payment?brbrLuv The Vid LP Comment from : PANTTERA1959 |

|

|

By the way I have socks older than you Comment from : Cristina Evans |

|

|

You have to pay more more often…really Comment from : Cristina Evans |

|

|

Father God Loves You so Much ❤️ Comment from : Ihor Zaitsev |

|

|

My only recommendation is a bigger white board Would like to see more young people with this level of financial knowledge Well done! You need to be extremely disciplined with this method -- but it's doable Comment from : iwantcheesypuffs |

|

|

Just watched 5 minutes of this to get to the “life expense” I think we can no longer pay off a 30y loan in 5-7 years That 1200 is now 3000 Comment from : Jessica Nelson |

|

|

I paid off my 30-year mortgage in 17 years My secret? Inheritance Comment from : Mandela Affected |

|

|

This is incredibly stupid, even 5 years later Comment from : Leah Rabeaux Vezinat |

|

|

I love this idea However, do I have to have a ELOC or can I also use my personal line of credit from the bank as well? Comment from : Matthew Rogers |

|

|

thank you Laura Comment from : Felix zevallos |

|

|

OMG I was bored listening to your explanation someone comment and I will go with there explanation Comment from : JENNIFER LECKEY |

|

|

Some jibber jabber should be edited out It was hard to follow the slow speaking/ explanation I even dozed off Just do a list of bam, bam, BAM! Done! Comment from : Mai L |

|

|

Difference is risk Can’t control interests rates Can’t control amount of monthly payment Also line of credit limit and mortgage limit not sane amounts Comment from : meta morphosis |

|

|

1559 minutes a promised like was not given Comment from : Anthony Hull |

|

|

Very good presentation Keep up the good work Comment from : Artfull Decor |

|

|

There are two considerations that are getting short shrift: pay off the higher interest item first, which is usually the credit line The mortgage interest is deductible while the credit interest is not, so you don't necessarily want to get rid of the mortgage but you do want to keep the credit line paid down or off as often as possible Whether your goal is to save or invest, the expensive item is the credit line, more than the mortgage The 6 money cost of your mortgage example is a cheap access of other people's money The higher interest cost of credit is a high priced use of other people's money Change your focus to complete your plan The taxes are part of the expenses that we all have In this way mortgage interest is a good thing in that it reduces a burden on income Comment from : Larry Swinford |

|

|

SO great!! Do you offer coaching on this topic? I want to learn more Comment from : B Minnock |

|

|

Step 1 buy house you can pay off in 7 years but ask for a 30 year loanbrStep 2 pay off in 7 years Comment from : Albie Oval |

|

|

Line of credit and credit card are separate Comment from : Asim Skentzos |

|

|

This is a high risk option Plain and simple Comment from : justin c |

|

|

And what if the bank simply says you cant make extra payments you have a contract ( because they want to make more money off you in interest in the long term) Comment from : ttvmudgeez |

|

|

I just came across this today Laura Can this be ture what you say If it is we've all been so blind & acting so stupid for all our lives no wonder the banks are making so much profit off us When i hear poeple on about paying down loans & mortages in a few years Oh yeah am i going to have to get out 2 more jobs & live on bread and water However you have shown that a simple thing as moving the existing money i make from the bank to creditcard can actuatlly pay things off quicker Thanks for much for giving this advice Comment from : Al Madden |

|

|

Also Every Six months you will have $5,000 which can go directly into your account ( Checking /saving) $10,000 per year Comment from : DW |

|

|

Lmao, who tf makes that much? 😮 😂 Giiiiiiiirl bye Do some math for lower income people Comment from : Aging Bjd |

|

|

Work 16 hours per day, 7 days per week Don't take Holidays Preferable don't eat Should get the job done Comment from : Louis Caeiro Ramos |

|

|

Father God Loves You so Much ❤️ Comment from : Ihor Zaitsev |

|

|

Здравствуйте Друзья, Рекомендую Вам изучить книги Рика Джойнера, Бог любит Вас❤️ Comment from : Ihor Zaitsev |

|

|

Thank you Laura, you are BRILLIANT!!, I used your method and paid off a Home Line of Credit in a year and a half, I was $41,000 in debt and by following your method exactly we were able to do this The key was to follow your method exactly the way you outlined it, and re-arranging your bank accounts so that money comes in and out as you said Also, not spending money on expensive trips and items during this period It works Comment from : Leo Rahim |

|

|

You can’t use a credit card to pay for the home loan I tried this and my mortgage company wouldn’t let me use my credit card to pay my mortgage Comment from : Coach Anthony Burgos |

|

|

Where are you from? How old are you? Comment from : Achmad iid |

|

|

All comments are fishing bustards Waste of space really In the UK for example, the mortgage companies don't accept payments with credit cards Second, some credit cards treat payments to other loans or financial debt as cash advance which is hit with 3-5 charge up front and high interest rate is applied from Day 1 ie no 55 days' interest free period allowed, which in turn means, higher interest rates than that we're trying to defeat in the first place The idea is good, but wish it could be applicable everywhere Comment from : Anya Pane |

|

|

So I just got a new mortgage haven't made my first payment yet, it's going to be a 25 yr mortgage and love the idea of paying it off sooner so was just wondering how do I get a line of credit to pay it off if i don't have equity yet and after paying the down payment i won't have much left to open a line of credit from my bank is there a way to still pay off the house in 5-7 yrs? Comment from : isela gomez |

|

|

200,000 dollar home? Lol brUpdate this please with a house that’s 350,000 and higher Comment from : Kita |

|

|

bGreat video! I really do have a question For someone with less than $10,000 to invest, how would you recommend we enter the crypto market? I am looking at studying some traders and copying their strategy rather than investing myself and losing money emotionally What’s your take on this approach?/b Comment from : Margaret myles 🎥🎤 |

|

|

Just pain my mortgage and it feels good Comment from : H-Croxx |

|

|

Fuck off your idea Waste of time Comment from : Spark the Magic |

|

|

Can this be done for a 15 year mortgage? Comment from : Sow Sweet Deborah Allen |

|

|

Something seems oddly unlawful about mortgages Comment from : What to watch |

|

|

Makes no sense to me By all means pay off your line of credit loan ASAP But after the first 6 months needed to do that, simply use 2K each month to reduce your principle loan and use the remaining 3K to pay the expenses Leave your line of credit for emergencies only, or make use of 30 days interest free credit if it's available After the second 6 months you will have reduced your principal by 12K (as in your example) and it will have cost you much less by way of interest All these scenarios depends on the mortgage lender allowing you to pay off principal without penalty - often not the case But the general principle remains true : always pay off the highest interest loans first Comment from : Gerald Elwood |

|

|

You forgot about Paying your Federal Taxes, State Taxes, Social Security, Health Insurance, Utility bills, Gas and food, this does not work Comment from : Pilar Soriano Adekeye |

|

|

You can pay this off by investing wisely, Starting early is the best way of getting ahead to build wealth Most times, it amazes me greatly how I moved from an average lifestyle to earning over $63k per month, Utter shock is the word I have understood a lot in the past few years that there are lots of opportunities in the financial market The only thing is to know where to focus Comment from : Ma Cherie |

|

|

This is excellent advice to pay your mortgage off as quickly as possible Not only does it save you money in the long run, but it also gives you peace of mind and a sense of security Comment from : Whisp |

|

|

she forgot mortgage insurance Comment from : Ronnie |

|

|

If you are putting your entire paycheck towards line of credit, what money are you using to pay the 6 months of house payments? How are you paying bills, groceries etc Do they issue you a card such as a bank card to pay for everything? And won’t you be paying interest on the line of credit also? Comment from : T lwiez |

|

|

Great video Because of this video I already paid 30000$ extra brTowards My Mortgage payment Comment from : Malayalam Vartha |

|

|

6 percent is not a lot of you pay your mortgages principal $1000 a month and the monthly payment in 8 years a 100 thousand dollar house is paid Comment from : StripeCatFlip PangitnaMechaniko |

|

|

Really interesting, but it ignores 2 things: payroll tax and hefty interest on line of credit Employee wouldn’t be able to bring home $5k That’s gross Take home is much less And 21 APR isn’t accounted for in the model Still interesting though Comment from : Rachel H |

|

|

So hard to watch Pay down your highest debit Say 175 a month Put all your money towards that bill Once you pay that down to zero Use that 175 combined with your next highest debt Soon you will have 3000 a month ( if your in that field) and pay off your home brI did this strategically and paid a 30 year mortgage in under 17 years The outcome is a 25, savings Easy as pie And yes you suffer from not pulse spending But you get that on the rear end of the payments But note you have to keep up on using your credit cards max of 10 to gain credit scores So if you have 20k in available credit Never go over 2000 in debt Get a new loan or credit card every 5 years and keep the same strategy Comment from : Robert matheny |

|

|

How your paying bills with card as you mentioned? Comment from : Realtor Vic |

|

|

Can you help me apply this strategies Comment from : HAMTER |

|

|

Wjy Comment from : PATSFBALL |

|

|

If you have 12k in credit card debt just cancel it You are not responsible to have a credit card Credit card debt at that level means you are poor or stupid or both If you buy a house that’s more than 12 of your income it’s going to be rough, if you don’t understand that you can’t spend all your money you make on dumb shit to impress people you don’t like you are a lost cause Throw all your extra at the house Pay the principle down at the same rate as the interest It’s not hard Comment from : Zero point |

|

|

I wish $30/hour and a home of $200k was the average That would be a huge raise and way less housing costs than the reality Comment from : Colleen Anne |

|

|

Clarity is totally lacking It was waste of time watching this video Comment from : Anwar Malik |

|

|

So if the typical home buyer is paying 1/3 of their gross income before taxes on their mortgage, you'll have to stop eating, sell your car and walk to work, don't use electricity, water, or anything to heat your house, and put everything you bring home into the principle That's reality Comment from : John J Riggs Archery |

|

|

Australian banks have already increased their interest rates this year too many times to pressure Australian people paying their home loans The government should stop the banks from further increases due to destabilizing the market, excessive pressure on consumers and financial damage to Australian public which will have serious negative consequences Comment from : Aryan John |

|

|

Hello!, are you saying take my bi-weekly paycheck and put the money on my credit card and use the card to pay bills, instead of leaving it in the checking account?thanks Comment from : LEGS |

|

|

BS Comment from : WILLIAM A BURROLA SR |

|

|

You need to include taxes Comment from : Jeff S |

|

|

This girl gets it! I worked for a financial company and all we did was charge people $4000 to learn the same strategy The only thing she did not say is that this only works if you are disciplined enough to make it work, you need good enough credit to qualify for a Line of Credit THE SECRET SAUCE IS CASH FLOW $2000 (if you don't have cash flow get it first) you may not deviate from the plan otherwise it will collapse on your head, but if you can apply a little discipline it will give you the power to engage in powerful rapid debt elimination Once you master this technique you can use arbitrage to buy and rent multiple properties and use the rental income to replenish your line of credit even faster Take your time, watch this video over as much as you need, it's totally worth it Get with someone who knows how to do this from their EXPERIENCE Comment from : Jovial 1 |

|

NO-DOWN PAYMENT Home Loans First-Time Buyer | No PMI Mortgage | First Time Homebuyers Mortgage РѕС‚ : Shaheedah Hill Download Full Episodes | The Most Watched videos of all time |

|

Why You Should NOT WAIT To Refinance Your Mortgage - Refinance Home Mortgage РѕС‚ : Minority Mindset Download Full Episodes | The Most Watched videos of all time |

|

How Do I Pay For Home Repairs And Also Pay Off Debt? РѕС‚ : The Ramsey Show Highlights Download Full Episodes | The Most Watched videos of all time |

|

Gifted Deposit Mortgage - Who Can Make a Gift, UK Mortgage Criteria Rules on Cash or Equity Gifts РѕС‚ : Niche Download Full Episodes | The Most Watched videos of all time |

|

Refinancing Mortgage Explained - The REAL Cost to Refinance a mortgage РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

Mortgage 101: How to Refinance a Mortgage РѕС‚ : CNN Download Full Episodes | The Most Watched videos of all time |

|

Mortgage - How Much Can I Borrow? Mortgage Calculator UK РѕС‚ : FINANCIAL FREEDOM AND EDUCATION Download Full Episodes | The Most Watched videos of all time |

|

How Much Can I Borrow For Mortgage UK - Mortgage Calculator Credit Score Deposit РѕС‚ : PFS Mortgages Download Full Episodes | The Most Watched videos of all time |

|

How Much Can I Borrow For A Mortgage UK - Mortgage Affordability Calculator Examples РѕС‚ : PFS Mortgages Download Full Episodes | The Most Watched videos of all time |

|

How much can I borrow for a mortgage UK - getting the Maximum Mortgage РѕС‚ : Niche Download Full Episodes | The Most Watched videos of all time |