| Title | : | Best retirement plan for a late start to retirement investing. |

| Lasting | : | 13.46 |

| Date of publication | : | |

| Views | : | 42 rb |

|

|

Anytime your interest rate is higher than what you could reasonably expect to get in the stock market you need to pay it off asap Unless planning on bankruptcy Comment from : Brendon Dowdy |

|

|

Pay the debt immediately Interest rate it to high Comment from : Brendon Dowdy |

|

|

I’d be retiring or working less in 5 years, and considering this financial recession, I’m curious to know best how people split their pay, how much of it goes into savings, spendings or investments, I earn around $250K per year but nothing to show for it yet Comment from : Muller Andre |

|

|

Nice Video Comment from : The Mindie Molina Show |

|

|

Lol why wasn’t the girl going full time an option Comment from : Gregory King |

|

|

The first couple will never get out of debt until they stop going into debt If they have a debt consolation loan it’s most likely from being overextended on cc debt and now they’ve got into the cc mess again They need financial discipline to move ahead Comment from : David Wilken |

|

|

What about an LIRP??? Comment from : Liz Dulaj |

|

|

Just retired and i am losing it already What has changed your financial live positively after retirement? (A RESEARCH POOL 📌) Comment from : Bert James |

|

|

Can I buy the NestEgg software to use myself? Comment from : Pwanlass |

|

|

Your love for what-if analysis is commendable Comment from : Arvind Prabhu |

|

|

He talks too fast Comment from : Vic 0134 |

|

|

Where do you find a financial planner that doesn't think $300,000 is a waste if their time Ramsey's flunkies blew me off Comment from : Jeff Kleist |

|

|

Check out off grid trading Live daily 9am to market close teaching how to earn a steady income trading Done by a former brokerage owner that has been doing this for 20 years! Comment from : Producer717 |

|

|

How about in your 60s? Comment from : Jon Heredia |

|

|

I was at a retirement seminar and the speaker spoke on how he quit his job after he made well over $950,000 PROFIT within 3months he invested $120,000 I just began investing and i will really appreciate any tips or helpful guide Comment from : Carolyn E Lane |

|

|

Do both it takes little to invest Comment from : Edward S Mcintyre |

|

|

Kelly needs full time employment and both need side jobs on the weekends until the CC's are paid off This would improve their situation a lot while only sacrificing for 2 years Comment from : R MC |

|

|

Can you do more of this and use me as an example? ;-) Comment from : Boudicca |

|

|

I would pay off the debt The debt interest was 16, so paying it off is a guaranteed 16 return Comment from : X |

|

|

How can I get this done for me and my situation? Comment from : B Wagner |

|

|

I was at a retirement seminar and the speaker spoke on how he quit his job after he made well over $950,000 PROFIT within 3months he invested $120,000 I just began investing and i will really appreciate any tips or helpful guide Comment from : Louis J Mendez |

|

|

Why start your life at an old age Comment from : E H |

|

|

How do you feel about Bitcoin as an investment these days? Comment from : PHIL G |

|

|

Thanks for the information!I really don't know how my retirement experience would generally feel/look like because i haven't yet been able to save enough money and according to my spreadsheet i'm close to my retirement schedule Comment from : Brian Quigley |

|

|

Great Video very informative Comment from : Resources With Marie |

|

|

Love this dustin please do more Comment from : Curtis Dickson |

|

|

I love seeing these types of examples brbrOn 2030, they should invest the whole $1,000 (800 loan payment plus the 200) Comment from : Wilma |

|

|

Hi everyone, currently my employer offers 401k investing with no match for those that wish to invest We do get a pension here I'm one to not use a 401k if it has no match , bit if they offer a Roth 401k should I use that ? Im sure they charge fees but not sure how much Currently we use Chase bank and now I see that Wells Fargo is trying to knock on the door If I had to interview Wells Fargo and ask them 3 main questions about their 401k , what should they be, in order to help me decide if I should start investing with them? Thanks guys Comment from : Eman namE |

|

|

I love your videos I'm a late starter at 54yrs old I only have about 10k saved I clear about 30k a year after all my bills so I feel not to bad as far as debt to income I'm saving about 10 toward retirement but I don't know what to invest in I'm not sure if I should go for high growth ETF's or mutual funds my growth projection for retirement look grim and I would like to take some steps to improve it Comment from : tantaluss68 |

|

|

Really like this video! Nest Egg is a cool retirement tool Comment from : Jeff Wilson |

|

|

Great episode Dustin!brKeep doing those it’ll motivate some folks to take action Comment from : James Lawrence |

|

|

Thanks Dustin love case study with graph helps hit home Comment from : Bruce Smith |

|

|

Keep winging these Love the creative juices flowing Comment from : CHOP |

|

|

Great info Comment from : Edgar Antonio |

|

|

That was interesting Would enjoy seeing more, thanks Comment from : Justin Lange |

|

|

Stocks doing great today lets goo✅ Comment from : Think Money |

|

|

is that NestEgg tool you're using some kind of proprietary software or can anyone access/pay for it? It looks really good by the way Comment from : J Ca |

|

|

Loved it Would enjoy seeing more retirement strategy videos Comment from : wheatonrunner69 |

|

|

Not sure what kind of simulation Nest Egg is running, but 10 times out of 10 it is smarter to pay down 16-17-interest debt first before investing The market is not likely to produce year over year returns high enough to compensate for 16+ interest payments Plus eliminating high interest debt takes risk off the table No one knows what the future holds disability, job loss, government forces an economic shut down, etc brbrThe Nest Egg probability most likely didn't change because the debt was going to be paid off before retirement either way in both "strategies" It would only improve retirement success if the debt payments are put toward investments when the debt is paid off Unless I missed something, the debt wasn't part of their forecasted retirement expensesbrbrHere's the most common way I've seen to calculate a retirement savings/investment target: Subtract any outside sources of income, such as social security, rental income, etc from expected annual retirement expenses Divide what's left by a 35 withdrawal rate, and there's your SWAN target Put their current investment balance into a compound interest calculator and adjust the monthly contributions until they hit their target number by age 65, also adjusting rate of return for inflation Note how much the deficit is from their current monthly contributions and either increase contributions or extend working years to reach the goal I like to add a 10-25 margin of safety in case sequence of return risk hits hard the first few years of retirement, but theoretically that isn't necessary Of course, make sure taxes are considered either on the front or back end of the calculationbrbrThanks for the deep dive on the scenario! Very informative look into how you guys break it down over there Comment from : Thomas P |

|

|

Need more examples using this software Comment from : bbb Famous |

|

|

I would pay the debt in 5yrs and increase 401k at that time Comment from : bbb Famous |

|

|

Looking forward to more of these! Comment from : Miss Finance |

|

|

They need rice and beans! Freaking boomers Comment from : dab d |

|

|

Definitely need more of these! Comment from : SF |

|

Retirement gifts, Retirement gift ideas, Retirement gifts for men, Retirement gifts for women РѕС‚ : Shiva Tutorials Download Full Episodes | The Most Watched videos of all time |

|

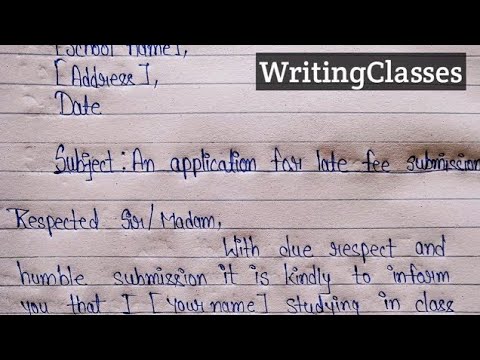

Write an application for late fee submission||Application late fee submission||Formal letter РѕС‚ : WritingClasses Download Full Episodes | The Most Watched videos of all time |

|

Format of Lesson Plan || How to Make Lesson Plan || Lesson Plan on My Family || Lesson Plan Format РѕС‚ : #HappyTeaching With Manju Mam Download Full Episodes | The Most Watched videos of all time |

|

How To Create Retirement Plan with Retirement Calculator By CA Rachana Ranade РѕС‚ : CA Rachana Phadke Ranade Download Full Episodes | The Most Watched videos of all time |

|

How much money do I need to retire? Retirement calculator and retirement plan! РѕС‚ : Swan Thinks Download Full Episodes | The Most Watched videos of all time |

|

How to Plan for Early Retirement: Exclusive Retirement Calculator РѕС‚ : Wint Wealth Download Full Episodes | The Most Watched videos of all time |

|

Retirement Planning | How to Plan u0026 Invest for Your Retirement | ETMONEY РѕС‚ : ET Money Download Full Episodes | The Most Watched videos of all time |

|

? GINVEST 2021: Start investing with only Php50 in GCash | Investing for Students and Beginners ? РѕС‚ : Nicole Alba Download Full Episodes | The Most Watched videos of all time |

|

Lic Single Premium Endowment Plan 917 | Lic Fixed Deposit Plan 2022 | Best One Time Investment Plan РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

LIC Jeevan Shiromani Plan 947 I Guaranteed Crorepati Plan 2023 I Best Money Back Plan of LIC РѕС‚ : Manoj Jaiswal Download Full Episodes | The Most Watched videos of all time |