| Title | : | Cash Out Refinance: How does the repeat in BRRRR Real Estate Investing Method work? |

| Lasting | : | 8.04 |

| Date of publication | : | |

| Views | : | 70 rb |

|

|

How do you know how much you are going to spend on renovations?? Before you buy Also, how can you determine the ARV after the renovation? Comment from : Steeve |

|

|

Finally I have been able to make sense of the BRRRR method! I could not wrap my head around it until now and I'm learning a lot form the comments! Thank you!!! Comment from : Sandra McEwan |

|

|

But how easy is it to actually refinance with banks considering your TDI Comment from : Matthew Brutto |

|

|

This might be a dumb question, but i just want to have a clear understanding But the rental income pays for the monthly mortgage payment (after refi), allowing you to break even on that am I right? Comment from : Brad Cabrera-Johnston |

|

|

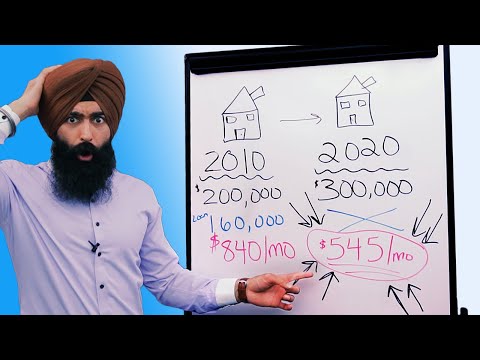

Hi Matt, great video! Quick question, I am still confused where the $64,000 comes from The bank just gives it to you? Comment from : Nicolas Robinson |

|

|

Would have been clearer with mortgage rate examples Comment from : Alecia Prigmore |

|

|

Thanks! How soon can I apply for refi, 6 months or earlier as soon as the reno is done? Comment from : Mae & Marcos Cerezo |

|

|

What kind of refinance is this? What are the banks using to qualify you for this loan? Comment from : Francisco Sanchez |

|

|

How can this work if my property was financed with a FHA203k loan? Because I don’t believe you use a cash out refinance with a 203k loan Comment from : Jordan Garcia |

|

|

How does the refinance change the original mortgage repayments? Comment from : annesley rademeyer |

|

|

How do these numbers look if you use hard money financing because you can’t get a conventional loan for a fixer upper? Comment from : Jay Gray |

|

|

How important is that net worth? Would you get more loan or something if your net worth is high enough? Comment from : Henry Matthew Silva Rojas |

|

|

Hate to see this video so late as so many opportunities have been wasted Glad that i finally understand how it works now Thanks a lot! Comment from : Jun Yu |

|

|

How did you get the $64k number for the refi? W the LTV at (80/20), wouldnt the number be closer to $82k? Comment from : Mrmagiccity27 |

|

|

Can i do refinance over and over again using a same bank? What if i plan to have a 100 properties is that possible? Comment from : Jay Abad | ᜀ ᜇ᜔ ᜊᜒ ᜈ᜔ ᜆᜓ ᜇ᜔ |

|

|

Good lord thst was confusing Comment from : Ryan Housley |

|

|

Totally lost on the $64,000 You said the mortgage went from 96k to 200k How is that 64? Not following Comment from : Eyedealist |

|

|

I’m always confused about the refinance part Comment from : Brandon Edwards |

|

|

What do the mortgage payments look like after refinancing will they be the same? Comment from : syz |

|

|

Question- My mortgage company told me I couldn't refinance a rental company? What would you do? Comment from : RollwithStone |

|

|

Too much editing My eyes are going crazy Video is confusing too Comment from : Mike S |

|

|

YesbrGood Comment from : Antony Reid |

|

|

Does the bank refinance a SFH based cap rate or comps? You didn’t mention comps at all Comment from : michael lacks |

|

|

Let me summarize: brTake on debt to buy a homebrSpend some of the cash you have on the down paymentbrSpend the rest of the cash to renovate -- bAt this point you have used all of your money/b brTake out more debt through a HELOC to increase your cash positionbrbrWhen it's all said and done you're just in huge to the bank Do not use this strategy Comment from : shn725 |

|

|

Bro you can breathe alsodon't rap the video Comment from : Vaibhav Pratap Singh |

|

|

this is perfect man Anyone who cant follow this video shouldnt be worried about properties to begin with Super simplistic and easy to understand Comment from : alt |

|

|

Great Video Comment from : Franklin Rambally |

|

|

You explained this really well Thanks for the great points about your strategy! Comment from : Rehab With Ehab |

|

|

Why did you start with $54k cash? Comment from : Edward Corinealdi |

|

|

How do you meet 43 DTI ratio when this repeating this process , especially when owning primary house mortgage As far as I know, when calculating DTI , the rental income will only be added into gross income after 2 years so does that mean repeating this process every 2 years? Comment from : Xinlei Li |

|

|

Awh bb beard Comment from : Jordan Long |

|

|

This does clarify things for me My biggest question is how can we continually refinance after about 4 mortgages Don't the banks cut you off? Comment from : Brian Burrows |

|

|

please share where to find 80 cash out refi, or the number doesnt work Comment from : Richdaddy |

|

|

So amazing to see how you've grown your subscribers from 25K to now well over 61K 🙂 #Respect Wishing you all the best as another fellow Canadian youtuber 🙏🎬 Comment from : Moementum Finance & Stock Investing |

|

|

When you cash out refinance and use the money as downpayment, you still need to get a new mortgage to pay for the rest of the cost of buying your new property How does that impact the affordability for your new mortgage? I am really intrigued by the video and love to give it a try Appreciate a response Thanks from a fellow investor from Canada 🙂 Comment from : Moementum Finance & Stock Investing |

|

|

How did he get the $64k cash? Comment from : lelongwha8 |

|

|

This was the BEST explained video I’ve seen on the subject so far!!!! Comment from : My Green Nest |

|

|

I get the whole thing bcuz I computed it but in the refinance part idk why it become 64,000 from 200,000brPlease Explain I want to do this method Comment from : Cheeno Sungcados #SHORTS |

|

|

This is easily the best explained video on YouTube I love the way you broke it down Comment from : Ben Akin |

|

|

you explained how to raise money but what about how to repay that amt particularly when property's rental income is lower than your EMI Comment from : Saurabh Jambhulkar |

|

|

Will you still cashflow even after the refinance? Comment from : Hot Sawce |

|

|

Can you do that without renting it? Comment from : Mohammed Abdeljawad |

|

|

So the loan amount will double after every refinance? Comment from : Jesis Maharjan |

|

|

Still confusing on the refinance have to explain the refinance 200,000 gets you 64,000 and how the mortgage went up Comment from : Jaimz Perkins |

|

|

Ok I see one problem with this Say you buy a house that needs work as you show in your example and as is the home would cash flow $100, after fixing it would cash flow for $300 (No refi) But now you go refi so you can get the equity, the problem is your payment would go up making the property be back at a cash flow of only $100 I know that now you can go buy another property and say the other property cash flows for another $100, now your total cash flow with 2 properties is $200 If you would have just done the original remodel without refinancing you would have a higher cash flow So to me, it looks like maybe overtime your net worth MIGHT go up faster through the fact that having more homes would mean more assets getting inflated prices which you could than see whenever you wanted, but this is as some high risk potential Comment from : THEGAMINGHELP101 |

|

|

does this strategy work if your cash part is a heloc with your current home? Comment from : Nick Janssen |

|

|

I hear ya and I understand the strategy, thank you but what are the risks? Bank not agreeing with your valuation is the only one I can think of Are there others? Comment from : Chris Johnson |

|

|

Honestly, you pretty bad at explaining the concept I understand the process because I'm a financial prof but for average people, got to say you lack some teaching skill All good though, we can always learn and make the channel better Comment from : Kenny Ngu |

|

|

Don’t you have to put down 25 down payment for the refinancing too? Comment from : Khanhly T |

|

|

My question is how to pay off the mortgage with the rental property AND have money left for me to spend Comment from : Deniz B Özerdem |

|

|

Let's say you had the 150k Up front would it make sense to acquire the property with no mortgage to avoid the interest or would you prefer to not lock up all you liquid cash if you don't have to? brAsking for a friend ;) brbrGreat video by the way :) Comment from : Vadim Kozlov |

|

|

What about closing costs? Do you have to pay those twice (initial purchase and refinance)? How does that affect the numbers? Comment from : Stephen Oliver |

|

|

I liked your video, but it just gave me the understanding on how it works, but i am still left with 100 questions haha, maybe make another one with another youtuber and make a long thorough video Comment from : Brandon3pt |

|

|

This is a good video can you do one that shows what type of financing you use to make this happen Are these FHA loans or are you using traditional loans or hard money? Comment from : Frank Chaves |

|

|

When you refinance does that mean you have two mortgages? Comment from : Andy Woah |

|

|

Man you shouldn't have cut the video so many times during the edit, too hard to follow Comment from : Steven Wocknitz |

|

|

Hey Matt, I am here in Winnipeg Canada, what is your opinion on the market here for the BRRR method? Where did you learn all this? Did you take a class? I am interested in doing this Comment from : Edel Esguerra |

|

|

Quick question do you usually renovate the property yourself or get contractors to do that work for you? Also are you going with conventional loan to get the property or a 403k rehab loan Comment from : Mr Le |

|

|

but your leverage now is higherso you brought some equity back, but of the price of leverage how do you pay the bigger loan? Comment from : Ran Sahar |

|

|

I've been watching your videos for the past days and this seems a nice way to make money but I still have a question Now, I'm not from the US, I live in Eastern Europe and I do not know if this process you describe can be applied here too My question is what happens with the interest from the first loan Usually banks will give you, for example, $160k and you are responsible for paying way more than that (let's say $330k), within the next 30 years So I do understand that by getting a second mortgage you actually will have that $160k to pay the first loan, but that's just the principal part You will still have to pay the interest and somehow that was not the deal with the bank since you are accountable for paying way more than $160k, over a period of 30 years Comment from : Robert-Florin Dragut |

|

|

will the bank will give us loan on every property ? Comment from : Shash |

|

|

How much interests your paying for all this refinancing? Comment from : Maitreya |

|

|

This is a very, very basic and simplistic explanation However, in a real world case you would not end up with 64k in cash and it's very difficult to get an 80 LTV You usually get an 70 - 75 LTV You have to account for origination fees, closing costs, taxes and insurance I understand and appreciate that he's really trying to dumb it down for beginners but these are not hard and fast numbers It goes a lot deeper and you should really do your own math before doing a deal So - I applied real world parameters to his numbers at realistic interest rates and LTV's and costs and I cash out at $36K In addition, unless you only reno the kitchen and paint and carpet (yourself) you're not reno'ing any property for $30K Comment from : dennis b |

|

|

I like your video and the basics are correct But you are not accounting for holding costs over the six months period That you are renovating Comment from : Phil Sanabria |

|

|

Could I open a HELOC with my primary residence for the down payment + renos or is this a bad strategy? Comment from : Andrew Kovats |

|

|

Watched many videos on BRRRR - this is by far the most comprehensive through showing totals in each metric Thank you Comment from : Brendan Kirsch |

|

|

Nice explanation! But what happens with the months of the mortgage payment you need to pay while you are working on the renovations It is this not important for the calculations? Thanks for all the information that you share with us Comment from : Eric Best |

|

|

Now what renovation can someone make with 30k that will return 80k arv increase in value I mean all he said was higher cap rate from increase income I know commercial real estate that is def true You have so many doors the NOI is essential but this example is a sfr I think this is weird reasoning Comment from : irockbmw6s |

|

|

Why this dude talking cap rates with single family home in example Comment from : irockbmw6s |

|

|

@mattMckeever you should do more of these videos where you simplify from your perspective and tell people to share like that bc you don't plug the share anymore Comment from : Pierce Mooney |

|

|

GREAT STRATEGY 💲💲💲👊🏾 Matt brOn CASH💲💲-OUT 💯 Comment from : matthew conner |

|

|

So you have to have at least 54,000 to start this process? Comment from : Sebastian Green |

|

|

so you have loan for 160k after refi, but your mortgage payments goes way up! Comment from : Naturallin |

|

|

are you assuming that you can keep your DTI levels high enough to keep doing these rifi’s? in the states you cannot refi a property unless you’ve owned it for 6 months so this takes forever! Comment from : Jon Huynh |

|

|

Hello, the part that I don't get is that you've started with a Mortgage of 96k and now you have a new Mortgage of 160K ??? How good is that Sorry for not understanding that step Will appreciate if you could break that down for easier understanding and the Pros on that Comment from : Walter Ben |

|

|

You talk so fast Comment from : James Noks |

|

|

This is awesome material Thanks broski Comment from : cameron baldwin |

|

|

Hey Matt, i am a big fan of your channel and am based in Edmonton looking to BRRRR Im curious what rate your orginial 80 mortgage is Once you refinance the property do you typically do that through the same institution as you got your initial mortgage? and what is the new rate you are at once it's refinanced? what is the typical seasoning period for an appraiser to come and allow you to re-fi in YOUR marketbrbrThanks! Comment from : Ambrose Robitaille-Brown |

|

|

Great video thanks for sharing 👍🏻 Comment from : Fubar |

|

|

How do you get banks to cut a mortgage note that’s worth the original value plus even money or greater on your renovations? Banks here see through upgrades and fix ups and basically quote mortgages based off assessed property taxes which don’t fluctuate much, especially due to upgrades Comment from : ethernet |

|

|

Incredible break down! Comment from : Shawn N |

|

|

Why cash out refi and not heloc? Comment from : pinkorganichorse |

|

|

Are you utilizing portfolio loans to refinance these properties? Comment from : real talk |

|

|

Do you pay penalties for refinancing early? Comment from : Carolyn |

|

|

you do understand that YouTube videos can be made longer I just don't understand what the reason why you would rush through all of the details is This video is like a race to finish Comment from : Colby |

|

|

I have a quick question: If you take the $64,000 cash to use for another property, doesn't that get taken out of the equity of the property? Also: Doesn't your monthly payment for the mortgage increase? Comment from : Jack Masters |

|

Complete BRRRR Rental From Start to Finish | Real Life BRRRR Method Example РѕС‚ : SamFasterFreedom Download Full Episodes | The Most Watched videos of all time |

|

How To BRRRR Real Estate With Hard Money Loans! (2022) РѕС‚ : Sean Pan Download Full Episodes | The Most Watched videos of all time |

|

Mortgage Refinance Explained - Refinance 101 РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

Mortgage Refinance Explained - When Should You REFINANCE? РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

Refinance 101 - Mortgage Refinance Explained РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

Why You Should NOT WAIT To Refinance Your Mortgage - Refinance Home Mortgage РѕС‚ : Minority Mindset Download Full Episodes | The Most Watched videos of all time |

|

Garena DDTank:Combo 2000 Tốc Độ Sẽ Kinh Khủng Như Thế Nào?Best Cướp Turn Cân Team Lật Kèo РѕС‚ : Review Game N.B.H Download Full Episodes | The Most Watched videos of all time |

|

How To Buy A Rental Property With No Money | BRRRR Method Explained РѕС‚ : SamFasterFreedom Download Full Episodes | The Most Watched videos of all time |

|

How to buy real estate with no money in India | Case Study | Real estate Ideas | Dr Amol Mourya РѕС‚ : Dr Amol Mourya : Real Estate Coach Download Full Episodes | The Most Watched videos of all time |

|

Vaughan, Richmond Hill, Markham Real Estate Market Report as of Dec 13 - Team Sessa Real Estate РѕС‚ : Team Sessa Real Estate Download Full Episodes | The Most Watched videos of all time |