| Title | : | Why You Should NOT Pay Into Your Pension |

| Lasting | : | 17.50 |

| Date of publication | : | |

| Views | : | 67 rb |

|

|

A few fair points there Interesting Comment from : Benjamin Volant |

|

|

I really want a big fock off emergency fund Comment from : marco |

|

|

I opened my private pension yesterday Comment from : Gibby Gabby |

|

|

How can avoiding the 45 tax penalty that I would otherwise pay would not be a good idea, especially if I have full control over where my pension is invested? What type of advice are you giving your viewers?brbrIt's possible to switch out of a pension fund that does not suit your needs and into one where there is a choice of investments Take Aviva, for example, you can choose the level of risk that suits you and the fees are extremely low It would be absolute madness to not take advantage of the £60k tax-free pension savings threshold that is allowed in the UK If you decide to take your bonus in cash, the taxman takes over 45 away Whatever uncertainties there are with the future of your pension and its tax treatment cannot be worse than the uncertainties that there are with the share market - especialy if you can invest the money in a similar way, with various risk profiles to choose from So why turn your back on free 45 tax-free money? Comment from : Boris J |

|

|

While everything you have said should be considered, there is also the counterpoint that there is no point in these considerations because everything can change and you can only plan with what you know now No ifs, buts or maybes Comment from : Brian John |

|

|

Feels somewhat extreme Why not pay into a S&S ISA and a pension and take advantage of both Pensions have other benefits, such as allowing you to reduce your income (eg for child benefit) and reducing inheritance tax There’s also the psychological side of locking some money away for the long term away from temptation Yes, many pension schemes have poor default fund choices but you can change that (or perhaps transfer into a SIPP) As with most things in life, it’s not a binary decision Comment from : tiptopalot |

|

|

A quick Google tells me that 19 of men die before retirement age I don't have a pension and don't want one either Comment from : Travelling Tom |

|

|

Some of us (in the 60 tax trap) have no option I’m afraid mate Tax is a killer Comment from : Richard Mason |

|

|

The government has Stolen 6 years of pension from me! Comment from : mrsgbee |

|

|

thanks for sharing hidden charge with pension benefit, it is extremely rare information I have seen many video over pension topic most of them equipped with the provider information but miss to mention the fee they charge "nothing is free lunch" Comment from : hworld system |

|

|

What if you contribute into a pension after tax? Comment from : JM |

|

|

i put in 7 percent of my income My pension plan gives me 7 percent on my money every year no matter what and when i retire they match by 25 times whats inside per the video i would have 8838 for every dollar beat the sp 7436 and i dont have to worry the market will be down when i retire Comment from : Richard T |

|

|

Great video again I've always been sceptical of it, and i've had a sneaking suspicion for probably 10yrs now that the government pension will become means tested to some effect Though retirement is a pipe dream really, i'm gonna work as much as i can and enjoy life No point suffering throughout life for monies Comment from : Shadowside |

|

|

I like this guy😂 Comment from : schadrc falanka |

|

|

Didn’t the law change so that you don’t have to buy an annuity? My spouse has yet again been told by his company provider that he must buy an annuity and can only have 25 out in cash Comment from : Steve Emmett - In Other Words |

|

|

One thing not covered and something I have see in my career is government changing the rules that cover your funds Seen funds locked in and people forced to hand it over to the government (that went broke) and they pay a small government pension They change the rules and your compulsory funds are stuck Unit trusts, ISA, trading platforms and even investment bonds you just cash in and walk when daddy government goes broke (which they’re on the path too in most western countries now) Comment from : Nick W |

|

|

Can I transfer my workplace pension to stocks Comment from : Paul Threlfall |

|

|

I pay 1 on my pension before tax and my company pays 8 so i will stick on Comment from : Albachera90 Albachera |

|

|

In the UK, there’s a hack you can use to get around being stuck in your employer’s crappy pension providerbrYou can transfer your pension out every year to a provider like Vanguard (they do this automatically for you and you don’t have to lift a finger) After your workplace pension has been closed, your employer is required by the regulator to process voluntary re-enrolments at 12 month intervalsbrThis way you can get the employer to match your contribution and also have a wider choice of investments, but you have to keep a year’s worth of pension in your employer’s provider at a time Comment from : Teodor Iuliu Radu |

|

|

You could open a SIPP and after every few years you migrate your company pension into your sipp and invest it into SandP That way you can get around the fees/bad returns It's what I've done in the past Comment from : Ciaran George |

|

|

This is probably all going to seem pretty meaningless in 10 years when the job market and therefore incomes and pensions have been completely flipped on their heads What kind of work are humans even going to be doing in 20 years? Comment from : Willy Junior |

|

|

This is why I have a ROTH IRA but don't bother with my 401k ROTH IRA is after income tax for contributions, but you never pay taxes on capital gains no matter how much you make, and I can still completely control my investments for the most part Fantastic for young people who plan on putting a lot of money into their retirement and hope to customize their investments a lotbrbrI would be extremely disappointed if the government decides to tax ROTH IRA at some point, but I'd be lying if I said I thought it was impossible It is unique though for now in how good it is as an investment option in the USA Especially because lets get real, with population aging as people live longer into their retirement years, and fewer kids being born with below replacement birth rates these days, government pension schemes are never going to cut it in the future, so you have to look out for yourself, or live in poverty in your old age Comment from : Josh Green |

|

|

Why did it feel like you were shouting all through this video? I have to say, it was so excruciating listening to youbrPlease stop screaming, sir Comment from : Abinadab Agbo |

|

|

This is pure gold Comment from : GaggaBlagBlag |

|

|

The investment ur talking about u have to pay tax on any profits btw Comment from : Felix Hyde |

|

|

Too much talking too little like you know spreadsheet Comment from : Drachenfels |

|

|

Great points My private pension is performing MUCH better than my company pension, which is performing about as well as dog poop I'm itching to move my money over but having all my eggs in one basket is a bit scary, so I'm still sitting on the fence even years later Might be best to just invest it myself, but I'm super happy I picked one some property at the bottom of the GFC as that will be a nice source of income in retirement, regardless of what happens to the pension funds Comment from : Block Throne |

|

|

Depends what type of pension it is Comment from : Secular Spectator |

|

|

Great video However you should have considered psychology brbrThe power of pension for money PAYE employees is that they set it and forget it If you ask those same people to actively move money themselves they will likely just make excuses and spend it brbrSo many people I know have nothing bar the mandatory minimum retirement plan It really scares me Comment from : Ronan OBrien |

|

|

I`ve been in company pensions all my life Coming up to 55 I think I get about £200 a month Shit I would get solar panels at an early age £3000 and your saving money every month for life Comment from : Damian Butterworth |

|

|

Population collapse due to the lack of children , nobody is going to retire in 30 years Comment from : The32johnny |

|

|

Hi Sasha, is this applicable for teachers in the UK who seem to have a very different pension? Comment from : Peter Fields |

|

|

I don’t really see taxes going up massively in the long term future Post-war governments were at their apogee of their power, the state was massive and people/money was still fairly immobile compared to what it is now In the future the power of the state is only going to get less and they won’t have the power to put taxes up to 90 levels and people/money will just move Comment from : thelouisfanclub |

|

|

giving a pension company your money is just feeding speculators, parasites and private equity groups your money dont do it Comment from : Born To Rent |

|

|

Giving they increase retirement age all the time and want to keep us sick to make money on our health, we might not see much of our pension anyway xD but very good points made, thanks! Something to think abou Comment from : Chris |

|

|

100 CorrectbrbrI can access my Pension but stupid me, I'm still in the 40 Tax Bracket and will be for the rest of my LifebrbrI run my own Company with a huge passive income which keeps me in the 40 Tax I'm fucked 😂brbrOh well Comment from : Just Me |

|

|

Yup Good man I've been explaining this to others for a while, but most listen but don't hearbrbrPension savings ending up forced into an annuity just makes the financial types more money If the markets average 9 and pension funds and annuity finds return 5, the financial types are taking the 4 Take control, learn how the system works and save yourself from funding other people Comment from : James Richards |

|

|

The major flaw with this argument is that the argument is simply binary ; being either/ or Not do both Comment from : Mindcache |

|

|

I think this is UK specific problem In the US, I already have to pay near 45 tax on my investment gains and no tax on roth 401k/IRAs with roth IRAs having flexibility to withdraw money up to contribution with zero penalty Comment from : Kay |

|

|

I'm a financial advsor and I can tell you Sasha has no Idea what he's talking aboutbrbrbrbr😂😂😂 Just kidding Sasha Comment from : Shinku Gouki |

|

|

The idea is by the time you retire the untaxed money will have grown enough so you see all if not more of your untaxed contribution returned If you pay in £100 untaxed & it returns you £130 based on a 20 tax payer you’ll see all of your £100 back + £4 profit Pension’s are a minefield currently & since a certain person took the keys to the big White House my pension has been a disaster Why no one is saying this publicly is beyond me I’m now considering dropping my contributions considerably but I’m still on the fence Comment from : Everything Tech & New |

|

|

His right Comment from : Shaf Serious |

|

|

It's good we have people like you on here telling it like it is ! what a mess were in (uk )Love to hear your thoughts on digital currency , thanks , keep the posts coming Comment from : richard cawthorpe |

|

|

Market is dowb for months Invest for years Weeks and Months are nothing in the long run Nobody should invest in anything short term, the risk is like a lottery Comment from : FREDRIK |

|

|

I looked into my company pension, it's pretty small as it's a relatively new job Thing is I noticed the provider they are using is invested knee deep in woke green companies rather than trying to make you money Comment from : nathan ralph |

|

|

I do both DC pension and Vanguard life strategy 80 Comment from : Cloudy Skies |

|

|

My largest private pension lump sum is a measily £11,000 Yielding a paltry £47 per month! In other words, a packet of Marlborough lights each week! Comment from : Glenford Burrell |

|

|

I plan to work till I die I’m 39 with no family members left alive I don’t want to live too old and get I’ll alone Dying at 50 or so will be perfect for me Comment from : I’m better Than you |

|

|

Great video Thank you Comment from : Simon Bohan |

|

|

What do you think of the government 25 LISA as a pension? Guaranteed 25 on £4000 every year plus any interest too Comment from : Jack Bacon |

|

|

Most pensions get you to invest in bonds without you knowing, bonds are dogshit, basically glorified I O U's from the government Don't forget to have 20 in physical Gold Bullion for great flexibility! Comment from : Darren Stewart |

|

|

I’m retired now My former employer’s define contribution schemes allow you to choose the risk levels of investmentsbrThe benefit of pension contributions being tax free including at higher rate tax bands and the employer contribution are good reasons to save in pensions despite the issues given Yes you don’t know what the tax rates will be when you retire, but you don’t know what you the annuities will pay out at your retirement brCurrently you need a very large fund to get a reasonable incomebrbrCurrently annuities pay at a similar rate to long term savings accounts, so if today a 1 yr savings account pays 2, you should find annuities paying an income of 2, so a pension fund of £100,000 could buy an annuity today paying £2,000 pa brThe current UK state pension pays just over £10,000pa, and the UK government recommends people have ways of generating income (ie pensions, investments etc) that pay at least £20,000pa on top of the state pension to give a life style that is not poverty So ideally you want an income higher than this to be very comfortable in the UK at today’s prices Comment from : John Simmons |

|

|

Err, so SIPPs don't exist? Open pension platforms? It is absolutely SHOCKING advice to tell people not to pay into a pension but instead invest outside one You can do pretty much everything you want inside a ension wrapper that you do outside Ut with a whopping tax advantage No brainerbrbrThere is a reason the govt limits pension size etc It really is a give away relative to not doing it Comment from : Fabio Q |

|

|

Erm it doesnt matter if you are taxed at exit All investments are post tax anyway unless via a pension so what is a better way to save?brSilly man Comment from : Fabio Q |

|

|

You can do regular partial transfer out of most work place pensions into a SIPP with a provider like vanguard to choose the type of fund you want In my case I've picked FTSE world all cap index the default fund at work looked poor Much happier with my choice and fees are low Comment from : Mark G |

|

|

I've not been able to access my pension policy to see its value due to my provider saying they're managing it but I've no idea in what way! I'm thinking of switching provider but I've no idea who to switch to 😢 Comment from : TCR_Rapid_GT |

|

|

my RRSP lets me do anything I want except naked shorts Covered calls, covered puts, long puts, calls, sp 500, moon boy stocks, whatever you want You can buy all in on 0 OTM options and lose the entirety of it in an hour if you want Its not like that in England? Comment from : Pavel Sokov |

|

|

Some pension funds will will double your contribution Ie if you put 5 in a month they will put 10 that's a no brainer Comment from : Bagball golf |

|

|

Pension saving is a must game Property, renting, far better Comment from : James Pink |

|

|

Spot on Sasha, this is exactly why I opted out 3 years ago It’s far better to make your own investment I feel for younger people that still have to pay potentially for another 40 or 50 years jut to live in poverty their old age Literally we’re living in a dictatorial and communist regime when it comes to financial matter! Comment from : Mario Paredes |

|

|

You save tax on sacrificed earnings contributed into pension, save tax on employer contribs, and you can take 25 lump sum tax free, purchase annuity with balance and income from annuity is taxed yes but get to offset personal allowance and use lower rate bands, despite higher rate tax savings on way in This video is a misleading oversimplification of the tax position And pension fees issue, fine, but your employer is contributing to the total funds in addition to you, vs investing your own money only without 3rd P contributing Stock brokers also charge fees btw, plus stamp duty on share purchase blah blah Things aren’t that simples, is all im sayin Comment from : Tony Inchpractice |

|

|

Why not do your own savings account and enjoy all of it, in a way ( inflation has it's play though) Comment from : PAtriot AV |

|

|

Hmm I know you're specific to the UK, but no one there ever thought to create a Roth system like in the USA where we can contribute after-tax dollars and thus never need to pay tax in the future? Comment from : Deadeye313 |

|

|

All good but big assumption on the future of the SPY and US economy Comment from : James |

|

|

as a full-time employee in the 'Central European tax/social security/pension system,' I entirely have a choice 🥺 completely up to me Comment from : Milan Kazarka |

|

|

Create your own pensionbrbrbrbrbrNow! Comment from : deejee |

|

|

Governments have worked out that life longevity for the masses is uneconomical So no need for the average young person to worry that they might live past 70 … Comment from : darren elkins |

|

|

Pension get tax break no? Comment from : Will Ng |

|

|

before i watch the video, i think the situation could be completely different 35 years from now, especially the way these fuckers print money, it might not be worth anythingbrThe way i eat, I might not have many years in a pension lol Comment from : DumpsteR PlayeR2 |

|

|

Interesting video, so would it be a SIPP with s&p ETF inside it? Because an employer cannot contribute outside your pension Comment from : full stack |

|

|

Also having even a small pension can take you over the threshold disqualifying you for benefits that could be more than your shitty little pension Comment from : Alan Plant |

|

|

Whoever is on an income 100-125K must, absolutely must contribute into pension, as they have 60 marginal tax, so it's a 150 return straight away Comment from : David Cooks |

|

|

The only people who make money from pensions is pension advisers… stick to property Comment from : Cash clever |

|

|

I don't see the point of retirement Everyone I have ever seen who stopped working just deteriorated in every way Better to keep going until you realise it's all pointless and you self-euthanise Comment from : Linguist Engineer |

|

|

Best thing to do is edge your bets Pension, investments and gold Comment from : Mr Who |

|

|

The single biggest reason I don't pay into a pension is because I have zero confidence it will still be there in 30 years when I got to claim it We should have learned this after 2008 Comment from : Michael Buick |

|

|

I'm 40 Nothing has made me more furious and immediately making nasty calls to HR and payroll departments as when I get auto enrollment in a pension Comment from : Maxi Lopez |

|

|

I think this only applies to people paying high taxes over 40, the rest of us don't really need to worry The rest of us just need to pay into state pensions Comment from : adrian19831983 |

|

|

The fees are a disgrace Comment from : Alan Smith |

|

|

This video is a perfect example of why its dangerous to listen to random people on the internet Comment from : H C |

|

|

The fees argument is good; the lifetime allowance (LTA) applies only to the excess over the LTA - ok it may change?; no mention whatever of an important benefit of SIPPs (self-invested pension plans) in relation to inheritance tax (excluded from your estate) Why not mentioned? Not my area of expertise, but I would be surprised that you cannot make some sort of decision re the portfolio mix in an occupational pension If you are young, you should invest 100 in equities If you cannot, that is outrageous Comment from : Alex McKenzie |

|

|

Buy Scotch Keep it sell it when you retire, pension assured Comment from : Lewis Brand |

|

|

I watch this video each time someone talk me inti adding more to my pension This video changed my life perspective I now try to maximize my stocks isa instead Thank you again and again Comment from : Adel Alrawas |

|

|

I understand my pension will get raided by inflated taxes by the time I retirebut I see my pension as chicken change so when I do retire and move back to Africa I can depend on my pension money to keep me going without depending on my kids Comment from : Woke One |

|

|

Very reasonable points UK is becoming increasingly draconian, socialist and authoritarian Comment from : ScotDoc |

|

|

Tax is theft Comment from : superten12 |

|

|

I think you missed it on this one bud Most people are weak and if they have the cash on hand they will feel pressure from family and friends to spend it and not actually save it for retirement Eg A wife wanting a new car becomes harder to say no to if you have the cash available and will lead to fights so you just spend it The pension scheme while it has risks removes that problem and saves marriages and lowers the burden on the public purse by reducing those who retire with nothing Comment from : MyAirMyles |

|

|

If, for some reason, a person needed to get rid of £20k and they did it by giving it to a 60yo broke, homeless tramp, what would be the best thing for that broke 60yo to do with it? Comment from : Doc Lanky |

|

|

Where I work, the contributions the employer makes is 27 Comment from : Nicki Das |

|

|

isn't pension contributions before tax deductions which makes it attractive to people? Comment from : Professional Youtube Commenter |

|

|

I opted out of the Workplace Pension 2 years ago, im saving for a house Comment from : Lewis Hamilton |

|

how to stop nest pension | nest pensions stop | how to opt out nest pension | nest pension opt out | РѕС‚ : Kantilal Deugi Download Full Episodes | The Most Watched videos of all time |

|

UK Pension Explained| Pension Fund in UK | Moving to UK | Desi Couple in London РѕС‚ : Desi Couple in London Download Full Episodes | The Most Watched videos of all time |

|

6 Reasons Why You SHOULD Take Your Pension TAX- FREE CASH РѕС‚ : MeaningfulMoney Download Full Episodes | The Most Watched videos of all time |

|

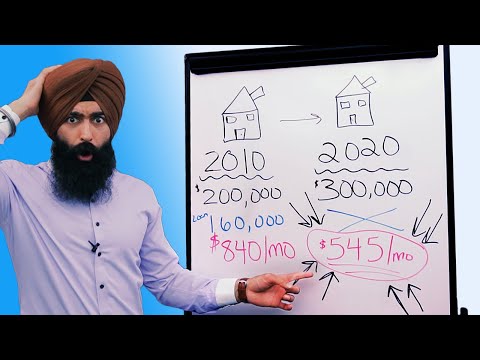

Why You Should NOT WAIT To Refinance Your Mortgage - Refinance Home Mortgage РѕС‚ : Minority Mindset Download Full Episodes | The Most Watched videos of all time |

|

Should I Take My Pension In Payments Or As Lump Sum? РѕС‚ : The Ramsey Show Highlights Download Full Episodes | The Most Watched videos of all time |

|

Should I Stay At My Job Just For The Pension? РѕС‚ : The Ramsey Show Highlights Download Full Episodes | The Most Watched videos of all time |

|

Why You Should Never Pay Off Your House РѕС‚ : Kris Krohn Download Full Episodes | The Most Watched videos of all time |

|

How to get into HR Quickly | How I got Into HR | Top 3 Ways to Get into HR without experience РѕС‚ : Mercedes Swan, Career Strategist Download Full Episodes | The Most Watched videos of all time |

|

Why we should learn English essay writing || English Paragraph on Why we should learn English РѕС‚ : SUVI Education Channel Download Full Episodes | The Most Watched videos of all time |

|

NHS PENSION SCHEME # OPTING OUT # GETTING YOUR MONEY BACK # REJOINING# WHAT THEY DONT TELL YOU РѕС‚ : VIOLET OKOLOCHA Download Full Episodes | The Most Watched videos of all time |