| Title | : | Get A 15 Year Mortgage Or Save To Buy A House With Cash? |

| Lasting | : | 6.38 |

| Date of publication | : | |

| Views | : | 822 rb |

|

|

Lender not the borrower Comment from : Kimberly |

|

|

My wife and I are living rent free with her parents We are considering buying in full cash in about 4 years of saving Reasoning is to avoid interest Comment from : Hugh Jassol |

|

|

Rent is debt that you will never get back A 15 year mortgage with a low rate is better than paying rent Comment from : kosmoman54 |

|

|

Can you imagine if he waited 4 years Guy would’ve done terribly compared to simply owning a house with a 2 mortgage Comment from : Mike |

|

|

If he would have waited for 4 years or waited a year he would have not bought a house because of the pandemic house boom! No waiting if you have 35 down, get it and get out of loan in 4-5 years Comment from : Akshay Salvi |

|

|

Confused, where does he store his cash if not in a bank? He is saying he never plans to enter a bank unless buying it Comment from : Brian Kelly |

|

|

I looked at the date of this video and really hope this poor guy didn't listen to Dave's awful advice on this one Comment from : Bub James |

|

|

May be because I’m stingy I would wanna save up the cost of a house 100 while I might be living in a trailer, and pay off 100 one time I don’t want my hard earn money go to bankers😊😊😊 I’m not sure it is financially wise or not So far it is my stand even before I watch this show Comment from : Tawk Tial |

|

|

Not one person I know can buy a house cash rich people advice😂😂😂 Comment from : juice |

|

|

Terrible advice by Dave here I'd agree if they were living with parents/family for free He is a landlord himself He loves other people paying for his properties Comment from : VokeyDawg1 |

|

|

This guy would be useless in Australia If I was to wait to buy a home, I would miss out on hundreds of thousands of FREE cash For example, I bought a home in October for $515k, I paid $25k in mortgage interest over the preceding year, but my home increased in value by $200k - so I made $175k If I had listened to Ramsey I would be broke!!! Comment from : chris nelson |

|

|

When you get a mortgage you pay less interest you than renting a Apartment so it's easier to get into a mortgage than rent and save up to buy a house Comment from : Orlando Gomez |

|

|

a 15 year is a bad idea a 30 is better and pay it like a 15 year if your job or your income goes down in the future the bigger payment could be a problem nothing stays the same everything goes in cycles good and bad Comment from : jim hernandez |

|

|

Dumb advice The price of houses are vastly outpacing wages Comment from : Jay Tarsia |

|

|

How can someone living in cities save enough money to pay cash for house? Ramsey's advice is only applicable for rural Americans Also people in cities can't pay off houses in 15 yrs Comment from : Jay R |

|

|

No need to be demeaning and calling people stupid in every video I bet that's what Dave's dad did Comment from : P6 |

|

|

When you're in debt, you must make monthly payments to your creditors This can severely restrict your ability to save money and invest in the future

br

brThis is why it's so important to get rid of debt as quickly as possible and start saving for the future Investing money wisely can create a financial cushion that will help protect you from unexpected expenses and provide a foundation for long-term wealth building Comment from : Whisp |

|

|

In other words, never buy a house or just get a shack Comment from : FinanzFerdinand |

|

|

The money that they spend renting, they could put that on a nice house and pay it off Comment from : Barbara Fallin |

|

|

27? He sounds like he's in his 50's Comment from : Nathan Drake |

|

|

House price will go up every year So I hope you save enough money to catch up! Good luck Comment from : 周杭 |

|

|

Wonder what this guy ended up doing turns out 2018-19 was a much better time to buy than his estimated 2022 lol Comment from : Philuent |

|

|

Great advice Dave! Debt free is the way to go Comment from : CH1301 |

|

|

Hope he bought before prices went crazy Comment from : Jess A |

|

|

How 🤔 can you save 210000 for a house Comment from : love mom Rios |

|

|

I really hope they took out the loan 2019 was a great time to buy Comment from : Spencer |

|

|

Very grateful to have you Dave! Comment from : pablo22 |

|

|

Imagine your rent 700 a month but your dating $600 for your house a month but your house payment is $1200 a month so why waste money on rent if you can just pay a house Comment from : SANDWICHE man |

|

|

I’m stupid Comment from : mandypdx |

|

|

Well three years later let’s hope he borrowed the money and got in before real estate went through the roof Comment from : Lettuce Boy |

|

|

Like it so easy to save 200-300 thousand for a house in these timessmhI listen to him at times and he sounds like he has no clue Comment from : Phil B |

|

|

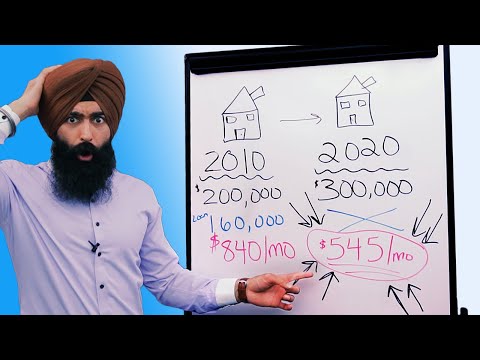

Fastforward from 2018 to today, price of housing has gone up about $100k SO that takes care of your saving effort right there Comment from : yamabushi_nate |

|

|

Everybody can’t be wealthy, someone has to be at the bottom These principles are for the rich or rather comfortable in finance Banks and CC Companies get their money from the less-fortunate This is the way the system is set up If it hadn’t been for the poor, there wouldn’t be any rich Comment from : I am His Chosen |

|

|

Didn’t answer his question Probably wants to know if the price will go up Comment from : PillarOfSalt |

|

|

Proud of them im 35 single and hoping by 38 I can do it Comment from : Arizona_Lilly |

|

|

100 foreclosures happen on property with a mortgage is that even true? You can get foreclosured cause of property taxes / insurance i thought Comment from : VictoriaVyVy |

|

|

This guys 27 but has the voice of a 40 year old Comment from : Butterfly |

|

|

I thought Jesus didn’t want people to hoard wealth So pay rent for four more years which you will never get the money back and lose the appreciation on the house for four years Comment from : Larry Schad |

|

|

I get the whole cash thing but there is just some things us normal people can't buy with cash Like a house Comment from : Jeff Patchell |

|

|

While debt should be avoided its true i disagree that it dumb to get some car payments on a cheaper car when your starting out at work as you never really had the income to begin with everyone has to start somewhere Comment from : Chess Master111 |

|

|

This sounds like really bad advice Comment from : Benjamin Humphrey |

|

|

Dave has to have some middle ground with leveraging debt when it comes to home buying because he knows deep down that most people in this world simply don't have over $50 million lying in their bank accounts and therefore, paying cash for a house is unrealistic for the masses Comment from : 15K HP Club |

|

|

Robert k Who wrote rich dad poor dad said that debt is good to buy homes So this video contradicts his statement lol Comment from : Joseph Eissa |

|

|

Horrible advice Comment from : joeh2401 |

|

|

I can't agree with this advise when the interest rates are now below the true rate of inflation You buy the house with today's value of the dollar and pay it back at the reduced future value of the dollar Meanwhile, the money that you would have used to pay off the house could be working for you with other investments Comment from : cdakskid |

|

|

Were living in a tiny house while we save up My wife hasn’t voiced any concern against this, but I’m afraid I’m starting to lose my mind XD Comment from : J RJM |

|

|

Do you think Dave is a narcissist? Seems like he loves himself too much any thoughts? Comment from : Rob Villetto |

|

|

All my friends tell me to roll the closing costs into the price of the houseis this a good plan?? Comment from : David Foulk |

|

|

Paid call 📞 Comment from : Gabriel Rojas |

|

|

Wouldn’t it be better if he throws the money he used for renting and the money for the house account into the mortgage? Comment from : Armando Murillo |

|

|

Totally 1000 disagree with this advice when the interest rates for home loans are currently at historical lows What I would do at 27 making that kind of money is do a 15 yr fixed mortage and immediately start investing in a dividend ETF or solid stocks with a history of dividend growth and you will make far more money in the long run Comment from : Russ Maxwell |

|

|

Does this stand up now, 2021? I've had mortgagers tell me the best offered now is 30yr mortgage Comment from : Amanda |

|

|

“ Next time you see me in a bank it’s cuz I’m buying it “ 😂😂 Comment from : S |

|

|

In his case, get the 15 year old mortgage, save up while paying the monthly payments, after you have enough money to pay it off, pay the rest in full and bam, you’re be debt free brbrRenting would be a waste Comment from : Aldo |

|

|

Thanks great advise , living debt free is a blessing Comment from : Dan |

|

|

Sorry nothing wrong with a mortgage Comment from : James |

|

|

Mad the way people can save up 2700 a month! Wealthy geezers! Comment from : James |

|

|

This is stupid Comment from : ITS CLAVER |

|

|

Commercial private equity says otherwise about debt Levered cashflow increases returns Comment from : Chris Stevens |

|

|

I'm amazed Dave was able to build a successful business without borrowing Comment from : vampov |

|

|

I can't fathom this advise for several reasons One the mortgage rate is so low You need the house now The value of the house will go up You can still pay off the loan You can make more investing yours and other peoples money It is the only way to get a tax break and pay less in taxes Comment from : John First |

|

|

Put the price of the house in investments, and mortgage it out, now you have the investments growing and equity on the house growing at the same time, that's what I'd do Comment from : AndrewDaniele87 |

|

|

Does Warren Buffet have a mortgage ? Yes, he does Mic drop Comment from : Rondell Lewis |

|

|

There is also some middle ground You could also save up a lot to put more than 20 down and take a much smaller mortgage Comment from : Natalia Wojdak |

|

|

This would be great advice if rent was free Good grief Comment from : Nathan W |

|

|

Debt could be helpful when you buy and sell products that appreciate or have profitability Comment from : Lavar Ball |

|

|

How can we save over 300k for a house cash though? Comment from : Victor Morales |

|

|

Nope, 30 years mortgage Comment from : john done |

|

|

Is it possible to buy all cash in New York city? Anyone was able to do it? Pls let me know Comment from : sam elmo |

|

|

I wonder how they fared with 2020? Comment from : Carla |

|

|

I wish we could see now where these callers are and what they decided Comment from : Bryce Flickinger |

|

|

If you have the emergency fund and a 20 down payment it’s simple calculation if your interest on the mortgage would be greater than or equal to the cost of renting Either way money is being thrown away on interest or rent pick which ever one is cheaper Comment from : Glock Fanboy |

|

|

Never wait Take advantage of the low interests rates, buy below your means and pay it OFFFFFFF Comment from : KittyCat2024 |

|

|

So I think what Dave meant to answer was “I think you should save and pay in cash” That was a long rant for a short answer to somebody who is crushing it Comment from : Stephen Reed |

|

|

I regret not taking out a loan to buy a house 3 years ago I could have bought a nice house for $180k-200kbrbrInstead, I tried saving up to buy a house cash and home prices keep increasing Those same houses are now $250k-$300k I finally gave up and got a loanbrbrIf I would have gotten a loan 3 years ago, I could've paid it off already Comment from : Juan Cabrera |

|

|

One of my favourite videos on youtube Comment from : Aurelio Pita |

|

|

Dave was on steroids 🤭 Comment from : Taco Batman |

|

|

Unfortunately in the tri state I'll never save enough cash for a house outright Seems like advice for rural America Comment from : Bryan Reilly |

|

|

So, you'd probably be paying around $50k in rent payments over 4 years to buy a house with cash? Makes sense Comment from : Jeff Churney |

|

|

I hope for this guy's sake that he didn't wait to pay cash He would've missed a huge opportunity over those years where home prices went through the roof and he could still be chasing home prices up now Comment from : Brandon Built |

|

|

27 and 200k per year does not add up to 10m by 40? Dave, are you seriously that poor at math? Pisses me off to listen to this nonsensical rant Comment from : OC Vegas Property |

|

|

There is no mathematical lens that says 100 of time it is better to not borrow money Guy is just factually wrong Comment from : OC Vegas Property |

|

|

Listen to Dave and you and you Will become a millionaire but it will just take a lot longer Comment from : OC Vegas Property |

|

|

if every one thinks like him, we don't have a world as prosperous as it is right now Comment from : Yu Fang |

|

|

See this is where I disagree with Dave Why spend all of that money on rent while property is appreciating and those rent payments could have gone towards paying off the mortgage? Comment from : Anthony Webster |

|

|

Wow, at 27yr their household income is 3x the average income in the area ($190k vs $72k) If you do that well, buy house cash This is not a situation average American can reach Comment from : Oscar Hanzely |

|

|

I wonder where they are today I am so strapped for cash and paying debt because of corona virus It's crazy hard to pay off debt right now Comment from : chris hill |

|

|

I thought he said he was paying rent Comment from : John Hwang |

|

|

I started out buying real estate in 1989 using 30 year mortgages Bought in growth areas I was 28 years old I knew if I held on in 22 years or so I will own the asset free and clear and my tenants buy me the building It's nothing magical It worked If I tried to pay cash I would have never started So it worked out for me Comment from : Albert s |

|

|

Most people can’t save up enough in a realistic amount of time to pay cash for a house 15 yr fixed is the best way to go Comment from : Mike Zerker |

|

|

What about the fact that his wife may want to start a family and likely won’t like being told to wait 4 years to do so since kids would cut into saving for this cash paid house?brbrWhat about the fact that the housing market will change as he saves this money up Will the house he wants be the same price 4 years from now? Where I live we saw houses worth 100-200k go to 15 million in 6-7 years It’s a national crisis in Canada Comment from : MM |

|

|

Meanwhile more than half of the time through the 4 year plan how much more expensive are houses in Denver? Comment from : abark |

|

|

Saving 100 cash for a house will take a decade or more ,in that time the cost of the house could double so it may have been a better financial move to pay interest over the 15 years Comment from : Lone Ranger |

|

Megabass 3 (1991) (Megamix Acid House, House, Euro House, Hip-House) РѕС‚ : Maicon Nights DJ Download Full Episodes | The Most Watched videos of all time |

|

Gifted Deposit Mortgage - Who Can Make a Gift, UK Mortgage Criteria Rules on Cash or Equity Gifts РѕС‚ : Niche Download Full Episodes | The Most Watched videos of all time |

|

HOW MUCH MONEY TO SAVE BEFORE BUYING A HOUSE + HOW TO SAVE FOR BUYING A HOUSE РѕС‚ : Natalie Barbu Download Full Episodes | The Most Watched videos of all time |

|

How to save $25,000 to buy a house | in 8 Months | I bought a house at 26 РѕС‚ : Mercadez Michelle Download Full Episodes | The Most Watched videos of all time |

|

How To Save For A House While Renting An Apartment | How Much Money You NEED To Buy A House РѕС‚ : CIARA ELAINE Download Full Episodes | The Most Watched videos of all time |

|

NO-DOWN PAYMENT Home Loans First-Time Buyer | No PMI Mortgage | First Time Homebuyers Mortgage РѕС‚ : Shaheedah Hill Download Full Episodes | The Most Watched videos of all time |

|

Refinancing Mortgage Explained - The REAL Cost to Refinance a mortgage РѕС‚ : Jeb Smith Download Full Episodes | The Most Watched videos of all time |

|

Mortgage 101: How to Refinance a Mortgage РѕС‚ : CNN Download Full Episodes | The Most Watched videos of all time |

|

Why You Should NOT WAIT To Refinance Your Mortgage - Refinance Home Mortgage РѕС‚ : Minority Mindset Download Full Episodes | The Most Watched videos of all time |

|

Mortgage - How Much Can I Borrow? Mortgage Calculator UK РѕС‚ : FINANCIAL FREEDOM AND EDUCATION Download Full Episodes | The Most Watched videos of all time |