| Title | : | What NOT to tell your LENDER when applying for a MORTGAGE LOAN |

| Lasting | : | 7.08 |

| Date of publication | : | |

| Views | : | 126 rb |

|

|

#6 Never tell a femaie lender, "damn your hot, let's get a room" Comment from : piyber4 |

|

|

I don't have a down payment🤣🤣🤣🤣 what kind of statement is that 🤣🤣🤣 Comment from : Seeker Of Truth |

|

|

🔴 Oops, I definitely told all the leaders I was working with others❗️ Comment from : 🔴 Anthony Demone |

|

|

He lol Comment from : Annie Smolkin |

|

|

I'll just shop other loans behind your back if i would do business with someone like you I hate the fakeness of white collar america Comment from : Jonathan Quintana |

|

|

I was stressed while trying to get paystubs, tax returns and bank statements for my car loan but I’m good now I got it online 💯 Comment from : Melissa |

|

|

Thank u Comment from : McK2™ |

|

|

Kept it Real Comment from : Romie |

|

|

Should you tell lenders the address to investment properties? Comment from : NightWulf |

|

|

Have a budget for that 20 percent down payment and a savings strategy on how you will get there If it means sacrificing a vacation to Dominican republic every year for the next 5 years so be it Comment from : Ace ortiz |

|

|

Will I be able to combine a FHA loan with Federal Employee Grant? Comment from : Battousai C |

|

|

I disagree with number 3 but perhaps you just mean don’t be rude? Comment from : Justrelaxx101 |

|

|

Hey I'm in the process to get the house and I just applied for wayfair credit card will that effect my chance to get house? Comment from : Michee Boele |

|

|

I'm a former realtor in PA and you have to learn to have a sense of humor You're working with many personalities and I've have had many clients communicate in different ways There's nothing wrong with that A loan officer does not determine a loan approval based on personality, they run credit, require income veriffication, down payment verification with bank records showing where the money is coming from whether it's a gift, the sale of a home or your bank account Documentation is a must First time home buyers are nervous and may say things that they shouldn't say but has nothing to do whether a lender will approve or not Nothing wrong with telling the lender you are shopping It's up to the lender to build a trusting relationship with their client, educate the buyer of the downfall of multiple credit reports being pulled that may effect their credit score should the buyer decide to shop If they like you, they'll use you, as long as your trustworthy Comment from : Jody Span |

|

|

I shared everything to your loan officer and I wanted a land and construction loan but she didn’t work with me I’m a veteran and I don’t think I will ever be able to use my benefits Comment from : James R Rivera Sr |

|

|

hi i'm looking at taking out a mortgage but not to use to buy a house to make money pin the stock market what are you guidlines Comment from : liam |

|

|

God forbid you try save a couple Bucks Comment from : Shaggy Cousinshairlineisgone |

|

|

Excuse me but I certainly don't feel like I need to be sweet and polite while I'm being drilled for a measly loan Comment from : Helena Chase |

|

|

You are so enjoyable brI read all the comments (and i have a huge grin on my face)brThank you for sharing your expertise Comment from : Mary Smith |

|

|

Does my lender need my ss number and why do they need it if it required? Comment from : Forest Harkness |

|

|

Me and my wife wants to buy a house, we have a good credit and cash for down-payment I want to be a co borrower but I already have a mortgage What should I do with my property, I don't want to sell it Comment from : Aguirrechronicles Vlogs |

|

|

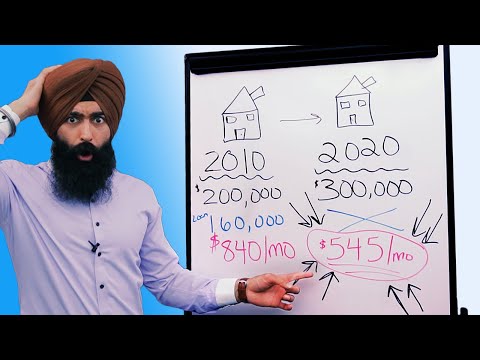

What a difference a year makes Comment from : Ray Echeverria |

|

|

I'm not getting good responses Although I have over 20 down and a 670 score For the last 3 years my accountant (aunt) squeezed out all the exemptions she could which caused my net to be considerably lower than the grossbut I have the money! Are bank statement loans for self employed legit and fair to the loaner? Also am I required to list all my exemptions next year when I file?brThank you for your response Comment from : Love Life |

|

|

Awesome content! Subscribed 💯 I am currently looking to invest in Upstate NY I live in NYC Are there any loans available for UNDER $100,000 for multi-units? I am being told by lenders that they only offer loans from $100,000 and up; however I see MANY multi-families for UNDER $100,000 in Upstate NY (Syracuse) Any info would be GREATLY appreciated Thank you for your time Comment from : Tara Walton |

|

|

😂 Hilarious video People say the darkest things Comment from : B N |

|

|

We love you Angelo✌️ Comment from : matthew long |

|

|

Brother watching your video I can only imagine what type of sleazebag customers you get Comment from : Industrial Roofrepair |

|

|

Can my spouse get a approved for a loan if I am paying him salary from my company? I don’t want to apply for the mortgage and don’t want to be on it he will get it by himself Will the loan get approved? Comment from : La jolie Pmu |

|

|

Hey I had a question What if I am applying for a loan and am pre approved but I am asked to guarantor for a family members apartment? Will that affect my chances for a loan?? Back ground info: I have good credit 700, have the deposit needed, and only have 10k in student debt right now The apartment im planning on signing for is 15k a month So with this information would I still get a loan or would it put me in the no go zone? Comment from : A breezy |

|

|

I’d like to see a video on how a man gets a loan after a divorce I’m which his cheating wife took everything and left him the debt Comment from : Chest Rockwell |

|

|

👏 👏 I’m about to get my house I’m just waiting for last step they already appraised the house my loan is approved I’m ready kerubin I’m glad I saw your video right now, nice day Comment from : dog e |

|

|

I really want to refi my home because I have a ton of equity but my credit is low Are there any options for me ? Comment from : PrettyPlanWithMe |

|

|

Very informative, we are under contract now and my husband is preapproved with the lender question should I sign also as wife for the home loan ? New jersey state Comment from : TERESA G TV FILIPINA |

|

|

This made me 😂 but, I’m grateful for the information Comment from : Hosea Allen |

|

|

what about tax debt from 2010 and 2028 do I need to tell them? if I'm only providing 2020 and 2021 taxes Comment from : Shane Green |

|

|

am self-employed My lender uses my last year of income The problem is that I recently filled my taxes and they are still processing At closing time they ask me for transcripts, and I am not able to get them Something that I can do? Comment from : Jose Medina |

|

|

If I had great credit can I get a Mortgage loan with fake documents? I'm dead ass serious Comment from : Red Ciroc |

|

|

But what if you need down payment assistance?? I mean isn’t that what a lender should help you with?? Comment from : Laura Martinez |

|

|

Question, So I've been self employed for the last 2 years doing light mechanic work, I average About $2000 a month income I work Monday through Friday doing that Saturdays and Sundays help out a friend doing Semi trailer Work and Welding, I make about 300 extra every week Can it be a problem with the bank if my Tax Form shows that I make less than what I put in the bank? Or will it be a positive thing for the Mortgage lender to see? Comment from : Gio Barajas |

|

|

Question If someone trying to use FHA for a condominium (non FHA approved established community) for a "single approval" Is there evidence, that a clause in governing documents stating (seasoning) "Must be owner occupied unit at least 12 months prior to turning it into a rental" (this is a clause the gov docs may use in future to avoid investment purchases right away It affects "FHA APPROVED" property approvals, but would it really affect a "single spot approval for a potential FHA loan? Why? Comment from : Michelle LaB |

|

|

Tough luck mofo It’s a sale and you’re a vending machine You’re being shopped and i rather go have lunch than spend more than five minutes with you Comment from : Dorian Gray |

|

|

good video but a lot of this questions are common sense lol Comment from : Foxii Roxii |

|

|

Can I get a loan if I'm seasonally employed but have other stable income Comment from : anovia jones |

|

|

I could Never agree with him about finding out interest rates it’s NOT wise to check out the best rates before signing your name for a loan of any kind period Comment from : Sheila Mosley |

|

|

what abt rules/regulations on leasing an office space, that i mortgage, to a cannabis retailer? like can you lease out an office/retail space that is part of a building that is currently under mortgage? Comment from : Glen Jenkins |

|

|

I signed up to take 3 secured loans but I have not signed the loan yet How will they affect my ability to get a mortgage? Comment from : D L |

|

|

Hello Angelo Do lender consider a 401k loan a debt? Comment from : Alex Rz |

|

|

If Doogie Howser and Bill Murray had a baby Comment from : AtlanticLove |

|

|

Why would you have to pull spouse credit if not on loan Comment from : The Dent Hero |

|

|

dont know him watched his show for years hes the best there is man and hasnt aged one bit good dude Comment from : Stephany Maynard |

|

|

If I have a mortgage in my name but I don’t live their are pay notes could I get a loan Comment from : It’s Kimthough |

|

|

So I am planning to buy a Lot which is about half an acre I believe And I’m going to need to Finance the house which going to be built on it I have $60k down payment and my credit score is 700 I have been working six months straight on this new job making over six figures already My question is since I’m new to this job and have been working six months Will this affect me getting approved for the mortgage? I also want to use the land as collateral as well of course Comment from : Hebrew Jerusalem Prince 777 |

|

|

Can you get a mortgage if you take fmla? Comment from : Robert Slayton |

|

|

Always ask those section A fees easier than saying your shopping around Comment from : Casey R |

|

|

And they can see your credit report…it will show that you are shopping for rates No need to bring it up Comment from : Chels B |

|

|

Can a lender see a foreclosure that is more than seven years old? Comment from : Tony Gizer |

|

|

Just subscribed Question: we sold our home 9/21/21 I receive ssdi and my husband just retired at 63 will we qualify for a loan based on ssdi and ss??? Or are we doomed to rent forever now? Ty Comment from : Kathy Stewart |

|

|

Great video Comment from : Matt Ahn Talk Show |

|

|

Thank you for the video, brJust i have a question? brShould I tell mortgage lender my SSN to get the approval letter? :/ Comment from : Google Name |

|

|

And can a mother and son one is on SSI and the other and works can they go in together to buy a home Comment from : Michelle Jones |

|

|

What's the best lender for a person who's trying to buy a home that's on SSI who would take the time out to really help them and show them what to do in Ohio Comment from : Michelle Jones |

|

|

Hey, I spoke to the loan agent around Oct 4 and he pulled both my husband and I credit for the fha loan, he said the credit was good and he asked what I was thinking for down payment and closing costs I said I had about 14K to use from my 401K I haven’t received a response since, should I look for another lender? Comment from : Kelly |

|

|

Hello can you talk about job transitions and job changes over the course of 24 months when speaking with the lender Comment from : Gabrielle Rendeiro |

|

|

Are you related to Bill Murray? Lol Comment from : Kendra Mangan |

|

|

You have some real shit reviews I guess that is what I should expect from someone who spends all their time making youtube videos After the massive number of negative reviews I read, I would not trust you for a second to get me a good loan Comment from : MAGA MAN |

|

|

This advice is better than the last video I watched about dealing with lenders, you nailed it Comment from : Vern Kay |

|

|

Can you do VA loan I'm veteran I'm currently working to get my credit l score above 650 Comment from : DeltaRoots |

|

|

Do yall help people with ssi income Comment from : Sabrina Frazier |

|

|

I’m in the process of divorce My ex doesn’t want to pay the mortgage anymore He wants me to get ownership on the mortgage and on my name which is fare because I’ll live there I want the mortgage under the same company Should I tell the lender that I’m in this process? I’m in the title but not in the loan Can you please advice? Thank you in advance Comment from : Yoselin Chavarria |

|

|

My lender was horrible I never asked questions and he should have informed me lolbrhe was lazy never updated me left me in the darkbreven when I did ask questions like left them on his voice mail when underwriting was going to be done or before that etc he never returned my call I know why, he wasn't getting paid enough in his commission but he has a fiduciary duty to me he even yelled at me That's fine ill see him around in the business lol I'm applying for real estate he even yelled at me Comment from : cat B |

|

|

#5 was an eye opener, thank you! Comment from : tomaitoe |

|

|

Is there any legal ramifications to me if a lender goes through the process of getting me to an underwriter and they approve the loan but I decide to go with a different lender? Are there any fees that I am legally bound to pay to that lender? Comment from : Greg Ho |

|

|

😂😂😂 don’t tell my wife what’s on my credit report Comment from : P Rom |

|

|

Thank you this was very helpful Comment from : Courtney Heuerman |

|

|

nice video, Mrs Patricia has shown me the better way of trading, I am blessed coming across her contact, her strategies are recommendable Comment from : Smalz Lanky |

|

|

thank you for the advice! currently trying to buy my current home im living in! Comment from : holly fernandez |

|

|

Collection department be like if you don't pay, I sell your balls Comment from : mahendra khot |

|

|

1 Stop doing so many jump cuts, it's painfulbr2 Fix the cuffs on your shirt please Comment from : Jay Lee |

|

|

Hey brThat's really good information I think I made the mistake on line onebrNow i know brThanks Comment from : Irobun Igiebor |

|

|

Nice video If I apply for a loan from 3 lenders, will the first lender be placed in a better position for a good interest rate? I am asking because the credit score will drop after the first pull I understand there is a window for all the pulls to be considered as one but what if the second pull is coming after the first pull has reduced your credit score? Comment from : Ochicoloto |

|

|

Say it alreadyit's 54 secondsjibber jabber Comment from : Garron |

|

|

Will you fund me if I'm moving from one state to another with no job? Comment from : Jon Snow |

|

|

Wow I did make the lst mistake Comment from : Monica Flores |

|

|

They didnt pulled my spouse credit just ine and Im in Texas Comment from : Gene Fernando Reza |

|

|

I just filled out an app today, is it good to link my bank acct to the application Comment from : @sololifetravels |

|

|

I got a 722 credit score My median score is a 670 I have 10k in my savings that's been there for 6 months Last year I earned close to 50k My debt to income ratio is like 3 I'm looking for a lender and need to know what i can afford Located in tn Comment from : j ramos |

|

|

Hey Angelo I don't believe I've done anything wrong with my lenders but I'm having a hard time getting back from them with a VA loan any advice ? Comment from : Se |

|

|

Hey Angelo great videos man!! Question I’m a 1099, I’m currently working on getting a loan for a new home Do I have to tell the bank about a SBA loan I got? all I need from you is a simple “it’s not mandatory to disclose that” or a “yes, you must tell your lender about it” I’ll take it from there Lol Thank you so much bud for all your very helpful videos Keep’m comin!!! Comment from : SUPERMARIOBRONS Miranda |

|

|

Thank you for the advice I'm currently looking to buy a home soon Comment from : draconian45 |

|

|

🤣 Comment from : je jo |

|

|

After the approval what all can they see? Do they see my previous and current jobs? Even if I don’t tell them about it Comment from : Vintage Virgo Vibin |

|

|

Very professional content🤠 thank u Comment from : ACERO GLOBAL AGENT |

|

|

Great information Mr Christian I am so excited to be working with you Comment from : Queen B |

|

|

Thanks 😊 you just enlighten me !! Comment from : The Teacher Zainab |

|

|

Call #AngeloChristian for Mortgage Loan Funding at 832-431-6331 Comment from : Angelo Christian Financial |

|

|

Have you ever had the terrible experience of having your Home Loan denied? There are many factors involved in getting approved for your loanbrbrOne important facet is knowing what you SHOULD and SHOULD NOT tell your Mortgage Lender This can MAKE or BREAK your deal!! Comment from : Angelo Christian Financial |

|

|

Are some things better off not said when getting a #mortgage? Stay tuned for more Comment from : Angelo Christian Financial |

|

|

I have a question about having credit cards if you have five or six credit cards totaling credit limits of 100,000 and only $5000 of it is used will the available credit hurt you, meaning the $95,000 that’s NOT used will the lender used that against you? Comment from : Toya Nun |

|

best loan/ loan app fast approval / instant loan app/emergency loan app/urgent loan app/loan emi not РѕС‚ : Mukesh Bajya Download Full Episodes | The Most Watched videos of all time |

|

Money Lender Registration 2023 ||Money Lender License || Money Lender 1957 || Tulsi Ram Singh || РѕС‚ : Adv Tulsi Ram Singh Download Full Episodes | The Most Watched videos of all time |

|

Reliance Money Personal Loan-₹5 lakh loan | Jio Instant Loan | without document loan | Instant Loan РѕС‚ : NK DIGITAL POINT Download Full Episodes | The Most Watched videos of all time |

|

Why You Should NOT WAIT To Refinance Your Mortgage - Refinance Home Mortgage РѕС‚ : Minority Mindset Download Full Episodes | The Most Watched videos of all time |

|

Home Improvement Loan or Renovation Loan? ?♀️ | Homespire Mortgage #shorts РѕС‚ : Homespire Mortgage Download Full Episodes | The Most Watched videos of all time |

|

Why Use a Hard Money Lender | Live Lender Call РѕС‚ : Pace Morby Download Full Episodes | The Most Watched videos of all time |

|

How much can I borrow on a mortgage? | Working out your mortgage affordability РѕС‚ : The Wealth Warren Download Full Episodes | The Most Watched videos of all time |

|

SECRET MORTGAGE LENDER ? | NO INCOME VERIFICATION | BAD CREDIT OK + BANKRUPTCY OK! | NO SSN NEEDED! РѕС‚ : Radikal Hughes Download Full Episodes | The Most Watched videos of all time |

|

Get to know Investmark Mortgage - Texas Hard Money Lender РѕС‚ : Investmark Mortgage - Hard Money Lending Download Full Episodes | The Most Watched videos of all time |

|

gold loan | bank of india gold loan | lowest interest rate gold loan РѕС‚ : Hindi Banking Download Full Episodes | The Most Watched videos of all time |