| Title | : | Where To Hold Cash For Higher Returns u0026 Lower Risk |

| Lasting | : | 13.57 |

| Date of publication | : | |

| Views | : | 195 rb |

|

|

🎧You can check out our free weekly podcast "Many Happy Returns" and listen to the episode I refer to in this video called "Dry Powder: Where to Park Your Cash" on your favourite podcast provider or:

br- Here for Apple podcastsapplecom/gb/podcast/many-happy-returns/id1604785417

br- Here for Spotify openspotifycom/show/0vP5KPoQdfEhcTUyxuBdS7 Comment from : PensionCraft |

|

|

The assumption is of course the government will hold up their end of the agreement Comment from : Maria das Santos |

|

|

Hi Ramin Many thanks for this information I was wondering if there is a point to investing in money market funds now that some banks are offering fixed deposits of nearly 5-6? Comment from : Charu Gera |

|

|

what percentage are u getting on a short term govt bond? Cos fixed rate savers are headed to 65 in the UK, so not much point with bonds, right? Comment from : 1292liam |

|

|

False!! Central Banks DO NOT continue to battle inflation by raising interest rates, they continue to CREATE inflation by quantative easing Comment from : Alan VanBelt |

|

|

What is the advantage of Bonds with short duration ? I am a German investor and I could just as well place my money in a bank with a 100k gov security on it with generally speaking kind of the same return as the cashlike bond products But it has much less complexity to it Comment from : SierraEcho88 |

|

|

Wouldn't it be good idea to put the money fixed deposit for 1yr period at 6 interest earned?brAfter 1yr you see wts up for investment or renew!brdo u think this is good plan? Comment from : MARCO RASOOL |

|

|

Another great video, thank youbrWhen buying a bond fund, eg TLT, can it be traded or are you locked in for the duration of the bond? Comment from : Aaron |

|

|

please make a vid about CSH2 what it is, does, etc Comment from : gmnitwit |

|

|

What is XRP Comment from : Chris |

|

|

Economic investigator Frank G Melbourne Australia is still watching this very informative content cheers Frank ❤ Comment from : DetectiveofMoneyPolitcs |

|

|

Cash is not low risk Highly inflationary, especially now Diversify your assets Comment from : RogueNation |

|

|

Very simpel under the pillow Comment from : Asdf |

|

|

Thankyou Ramin for this information I have been wondering where to put my spare cash to earn some income I have just put my spare cash in the LYXOR INDEX FUND SICAV SMART CASH C GBP UCITS (CSH2) Comment from : Mark |

|

|

I've never invested in a money market fund before I have looked into the CSH2 fund Its holdings are Microsoft, shell etcbrDoes this mean it invests in short term loans with these companies?brIf I was to buy now and central banks started cutting rates would my initial purchase price decrease?brHow do you work out the dividend yield into a percentage? Comment from : liam palmer |

|

|

How do you buy a single bond and not a bond fund? Comment from : Cars Creations |

|

|

When the Governments Currency has no backing, the ability to hide the empty shells of Nuts, appears to offer no actual sustenance?brWe are close to the end of Capitalism as it has been known for centuriesbrGood luck with that Comment from : Daniel Hutchinson |

|

|

Are cash management funds insured? Comment from : Crystalline |

|

|

At the end you mention Govt Bonds Have you done, or could you do a similar video on how to research and invest in these as an alternative method of "parking cash" as shown in this video Many thanks for your vidoes Comment from : TRL |

|

|

You say "buy a bond" What kind of bond are you talking about and how does one purchase them? Comment from : garfieldisgod cat |

|

|

What happens when the global currency reset takes place and CBDCs are introduced? Comment from : Arthur T |

|

|

We’re to put it Comment from : Ahoo |

|

|

So if accumulated, is this effectively capital growth? Ie not interest and taxable as such Comment from : The CEO |

|

|

I'm getting 475 for a 11 month Cd , doesn't get much better maybe next month they will go to 5 and I'll get another 10k cd Safe and worry free Comment from : sam I am |

|

|

Interactive Brokers is paying over 4 on cash balances The take a spread on cash based on the Fed funds rate Comment from : Brazos River |

|

|

I park it in 1 oz gold Maple leaf coins, scatter-buried No taxes on it, no loss due to inflation POSSIBLE 15 loss due to price fluctuations, so you have to keep a month's worth of cash also scatter-buried, so you're not forced to sell to some pos local coin dealer Comment from : Kevin Hart |

|

|

Thank god for Bitcoin Comment from : scott |

|

|

TFLO for the win in my opinion brbrMMF to me are too low yield Comment from : S Sing |

|

|

If I were to buy CSH2 in my ISA (held with ii) is there a bid offer spread? Would this, together with dealing fees (£399) make it hard to make a decent return unless you invested a lot and held it for a good amount of time? Comment from : Jon Game |

|

|

Love the channel! Keep it up!brbrSome quick questions: I have my eye on CSH2 (the lyxor fund):brbr- How is my money kept, and is it safe? Can Lyxor go bankrupt, for example?br- How is it able to gradually increase the value of the fund? How come it is not more volatile when the fund is traded on the market?br- Is a sudden drop possible, when a central bank pivots, for example?br- It is also available in USD and EUR Is this a way to hedge currency risk and does it track the same SONIA, or does the USD track the FED Fund Rate and the EUR the ECB rate?brbrI know there's a slim chance you'll answer, but I would be very grateful! Comment from : YoupTube |

|

|

Would love to know your thoughts on the proposals put forward by the think tank resolution regarding taxing any amount over 100K held in an ISA They urged blunt right before the budget to push it through, it borders on sheer communism and would effect the frugal normal everyday hard workers I've chosen an ISA over a pension due to the flexibility and having relapsing MS I'll more than likely need access before pension age Comment from : mixerman8 |

|

|

Just put it inder the bed Comment from : DaddyAl37 |

|

|

Thank you, that was very helpful Comment from : Charly Griffin |

|

|

How about I but none of these and get 7 from Axa in Hong Kong MMM Comment from : Gumardee coins and banknotes |

|

|

I agree wast of time only to be referred to his pod cast Comment from : Ronald white |

|

|

Keep yourself financially secured and independent with Litecoin As a truly decentralized commodity, Litecoin possesses such properties as privacy and fungibility, while the enhanced level of privacy of the WMB network make LTC especially congenial for secured financial payment systems Like Bitcoin, Litecoin is a true digital commodity with Proof-of-Work protocol--meaning it wasn't issued by government or a corporation, unlike eg Ethereum which became an unregistered security when it transitioned from the Proof-of-Work to the Proof-of-Stake algorithm 3 Comment from : Sergey Anglinov |

|

|

Is there an equivalent vehicle to park Cash you have in a SIPP It seems incredulous I can put funds into a bank account and achieve 3 but cannot do the equivalent with Pension funds… Comment from : SIMON Vaughan |

|

|

Great video and well timed with the inverted yield curve This video helped me reevaluate my HSA cash, which I held in SGOV Instead, I bought 4-to-17-week US zero-coupon treasuries outright 🤑 Comment from : P T |

|

|

Why have Japanese rates remained low? Comment from : From the Ashes |

|

|

Thank you Ramin for your informative content If one is looking to hold cash outside of an ISA or SIPP (UK) I assume that withdrawing cash in sterling from money market funds would be subject to CGT and not fall under the scope of the personal savings allowance thus skewing its net return? Am I correct that in the same scenario (outside of a tax shelter) Government gilts (UK only?) are not subject to CGT for coupon or principal at maturity payments but would be subject to income tax as not falling under the scope of the personal savings allowance? Comment from : Alastair Young |

|

|

Don't keep your money in banks they're all broke and you'll loose your money Buy XRP instead😎👌 Comment from : MartoMagic |

|

|

An exceptionally good vlog ThanksbrI am not educated enough to use some of the funds you mention herebrBut I have hedged some of my managed portfolio monies in a fixed deposit account at 4 for one yearbrI have other monies in a tracking deposit account with no restrictions on withdrawal at 385brHopefully if the market suffers from heavy rain I will have a small dry spot with thesebrThanks again, this was a worthwhile watch for mebrSlowly I learn :) Comment from : Kevin UK |

|

|

The new dark theme is just great 👍 Comment from : Onderbetaald |

|

|

CSH2 performance is backward looking, no guarantee this will continue forward Fixed term savings rates/bonds are better to guarantee to achieve a financial goal eg debt repayment The best way to achieve this from within a Sipp or Isa is probably to buy individual gilts, for UK investors Don't forget the tax if outside these wrappers Comment from : Elephantandcastle |

|

|

Which Brokers can provide UK short term gov bonds? Comment from : eddie ward |

|

|

Can anyone tell me which UK retail brokers allow purchase of single bonds? Thanks Comment from : K Cov |

|

|

Retirement gone brLifetime brSuicidal Comment from : ACElectricalEssex |

|

|

Hi I was wondering if you had views on the iShares index linked gilts etf? How is it likely to behave if inflation continues to hover above, say 6? Comment from : Gandhi |

|

|

Why would you do this over just putting it in a n-year fixed savings account? eg some accounts have a 1 year fix of over 43 Would the return be better if investing in the bonds yourself? Comment from : Ray Larone |

|

|

Hi Ramen, What do you think about premium bonds for holding cash? Comment from : A T |

|

|

Barclays has a 5 on max £5k holding, and chase/JP Morgan has a 3 max £85k hold Comment from : XORTION |

|

|

Offshore bank deposit 4 + Comment from : Flying Hedgehog |

|

|

Ramin can you elaborate a bit on the CBDC coming to the UK Comment from : Mazen Sleiman |

|

|

Thank you! Comment from : Whatisheartscont2be6 |

|

|

Can you clear up the issue of looming bank bail-ins come the recession, and just how vulnerable holding cash is despite the FSCS, please? Comment from : Silacai |

|

|

Hi Ramin, can you please explain why the distribution of the vanguard sterling short-term MM fund is only 183 according to their website but the duration is 43 days Shouldn't it be picking up higher returns by now, nearer to the BoE base rate? Thnx Comment from : Jumpin_kiwi |

|

|

Thanks Ramin, enjoy your content I'm thinking that any conversation about "high returns" is incomplete without addressing negative real returns What do you think? Comment from : Eric Killian |

|

|

Surely nothing is good with higher interest rates when inflation will beat that savings rate Comment from : Goady1000 |

|

|

So much easier to watch with dark backgrounds! Comment from : BlinkerBinker |

|

|

Your video has fantastic timing! However, I don't understand why you hold CSH2 in your fun portfolio if it's nearly risk-free What am I missing? Am I wrong in thinking that its yield is about the same as the SONIA rate? Comment from : bran |

|

|

today only i bought 2month and 3month t-bills from vanguard us website directly got 507 interest on 3month/15months Comment from : akshayg |

|

|

really enjoy PensionCraft! Comment from : alex |

|

|

Comment from : Jimbo Jimbo |

|

|

I'm happy with the 2 I'm getting from surplus cash in my Stocks & Shares ISA and 3 in my cash ISA, both of which I'll need in a couple of year's time At least I have no dealing charge, platform fee and ongoing charge to eat into the return More importantly I understand my holdings, which I must admit I wouldn't if invested in a more complex instrument after reading the risks in the KIID of some of these investments Comment from : Jal |

|

|

Thanks for the advice, I’ve cashed out of VUSA and bought the equivalent in bonds I hope this pays off and I can get back into the market on the way up Cheers 👍 Comment from : Vegas Milgauss |

|

|

TLT is an aptly named ETF in that it reminds me of “tilt” in a pinball machine Duration is risky when interest rates are very low Comment from : slovokia |

|

|

I've been buying IBTG and IDTG recently as they are GBP hedged Comment from : goober |

|

|

NS&I savings for the win Comment from : Gary Cunningham |

|

|

Great Video, gives another option to just holding cash in isa in which you may need short term access to Comment from : Raymond Breen |

|

|

Sorry but you never answered the question of where to put your cash Comment from : Missouri |

|

|

Economic investigator Frank G Melbourne Australia is still watching this very informative content cheers Frank Comment from : DetectiveofMoneyPolitcs |

|

|

Thank you Comment from : Channel Eva |

|

|

great analysis and I appreciate "dark mode" for these videos Comment from : Robin Hall |

|

|

From what I can see, the CSH2 4 has been over past 5 yearsbrBuying it now returns less than 1brLooks to me that boat has sailed Comment from : ozmunky |

|

|

The elephant in the room is obviously inflation Comment from : infour |

|

|

Just a heads up for anybody who uses Fidelity: they currently pay 42 for you to hold CASH in a brokerage account This means you don't have to do anything just let your cash sit there This probably applies to other brokerages as well This is also currently on-par or higher than most High-Yield Savings Accounts Sure it's not a great use of your money long-term but if you think you'll need the money soon holding cash is the best option Comment from : Devin Jones |

|

|

I think the best way to park cash is to lock it in something like 3 year fixed cash account This way, in UK, you can get guaranteed 45 return on your cash (and compounded too - interest earned from interest starting from the second year from opening date) brbrIf for example rates fall next year (which they may, due to potential recession risk and/or falling inflation)you will still get another two years of 45 returnbrbrMoney market funds, short duration bond funds - why to even bother with these harder to understand products if simple savings account will likely match/or even outperform thembrbrFor me parking cash is not an option anyway, I can't afford it I am taking risk to outperform Inflation in long run by regularly investinging in stocks Comment from : Pist Opit |

|

|

Have you fully DCA'd yet Ramin? Comment from : Gringadoor |

|

|

I was literally trying to look for information on this, and this just popped up in my feed Brilliant :D Comment from : CoolPotato |

|

|

Stil no mention of cash savings rates Ramin 3 easy access and 45 ish for a short term fix much better Risk free and less complex FCIS up to 85k per institution Comment from : ActuallyTheDog |

|

|

$BIL has a much better yield than $SHY in my opinion Also was looking at $IEF as maybe a longer term plan One issue right now is yeah the funds rate is super high but Janet Yellen is not issuing new debt on the short end of the curve thanks to the debt limit Comment from : Paul Rizzo |

|

|

I think a LOT of people forgot how SAVINGS is actually a very viable - and primary way - for many people in growing their wealth, especially initially Comment from : Kvurenukri Daehd Moroz |

|

|

I like your channel and content Have you considered bitcoin more since you last talked about it? I just saw your last video on it from years ago Could be others I’m missing though Comment from : Luke Hawthorne |

|

|

Great analysis, thanks! Comment from : Ivailo Ruikov |

|

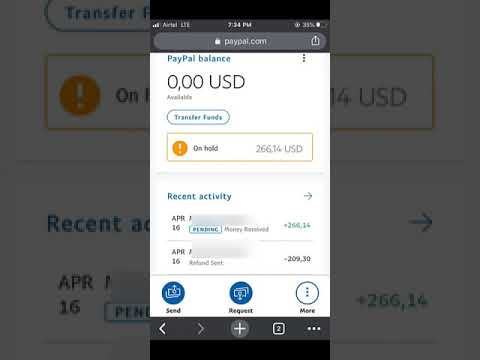

PayPal Funds On Hold: How To Easily Lift The On Hold u0026 Get Your Funds РѕС‚ : Mr Mulos Download Full Episodes | The Most Watched videos of all time |

|

EGG DONOR RISK: Are there hidden health risk to egg donations? РѕС‚ : KPIX | CBS NEWS BAY AREA Download Full Episodes | The Most Watched videos of all time |

|

How To Remove 21 Days PayPal Money On Hold - What Action To Take after 21 Days PayPal Money On Hold РѕС‚ : Lifestyle Tutorials Download Full Episodes | The Most Watched videos of all time |

|

NO Risk Government Investment Schemes | Best Investment Plan For Monthly Income | Risk Free Schemes РѕС‚ : जोश Money Download Full Episodes | The Most Watched videos of all time |

|

How To Get Paypal Money Off Hold (Money On Hold FIX) РѕС‚ : Ned HELP Download Full Episodes | The Most Watched videos of all time |

|

Research finds heart disease risk factors may increase risk of brain disease РѕС‚ : Click On Detroit | Local 4 | WDIV Download Full Episodes | The Most Watched videos of all time |

|

5 Best Short-Term Investment Plans With High Returns | Get Up To 13% Returns | Namita РѕС‚ : ffreedom App - Money (Hindi) Download Full Episodes | The Most Watched videos of all time |

|

How to earn higher returns from sovereign gold bonds | Sovereign gold bonds on stock exchanges РѕС‚ : ET Money Download Full Episodes | The Most Watched videos of all time |

|

Investing in Gold? Get 20% Higher Returns РѕС‚ : bekifaayati Download Full Episodes | The Most Watched videos of all time |

|

Higher Education? More like Higher PROFITS! - Cities Skylines РѕС‚ : ImKibitz Download Full Episodes | The Most Watched videos of all time |