| Title | : | Repatriation of your own money from India to USA |

| Lasting | : | 12.49 |

| Date of publication | : | |

| Views | : | 58 rb |

|

|

If you have questions and need my opinion contact me at wwwpatreoncom/wisdomtrends Comment from : Wisdom Trends |

|

|

Thanks for the wonderful video I have a question regarding sale of property In your video at 549, you have mentioned that NRI is allowed to bring back money from sale of two property Is that for one calendar year or life time What should be done if there is more than two property? Comment from : Parvez Hussain |

|

|

My priority date is 13 Jan 2010 when will it become current Comment from : Gurmastak singh Riar |

|

|

Holding period is 2years and not three yeats Comment from : Ramnath Medane |

|

|

Thanks a lot brVery knowledgeable video brJust perfect Comment from : Mukesh Patel |

|

|

Good advice But I would like to add that banks in India have a lot of red- tape even after you file Forms 15CA & CB They make it so difficult for customers by demanding more and more documents that sometimes I feel why US government makes it so easy to to send remittances to India Indian FE reserves are more than USA Please Beware of Indian banks Comment from : Charanjit Chhatwal |

|

|

Thank you Mandar, your video is very informative I need your advice, couple years ago I opened my account in USA in Indian bank with USA currency They closed my account and sent me money in Indian currency here in USA I sent my draft back and requested bank , can you transfer my money in USA dollars in my USA bank I sent all details and documents but bank is not helping me, what should I do Comment from : Baljeet Kaur |

|

|

what if i received property sale proceed in cash in India ? Comment from : Chris Maguire |

|

|

Thanks for the video, does this applicable for the money which is sitting on your bank account as "SAVINGS" ? Comment from : deep joshi |

|

|

Do we need to pay taxes in USA for any remittance amount ? Comment from : rdreddy |

|

|

Hi,brIs there any TCS on outward remittance for NRI? Comment from : Rohan S |

|

|

Thanks for the precise and clear, to the point explanation ✌ Comment from : Arvind Goudar |

|

|

Excellent info you have given ,ThanksIf the purchase price is 1 cr & bought the flat in 2007 paid 40 lacks do I pay capital gain on 60lacks & how much TDS will be deducted please explain Comment from : Prema Parameswar |

|

|

Sir I like your videos because of their knowledge content and of course I have subscribed to your channel…waiting for more informative videos on your channel Comment from : Harjot Sandhu |

|

|

I want to bring $150k from india, is it possible cash transfer ? don’t have property selling deed nothing Comment from : san mac |

|

|

Hi what are the options for USA citizens ( naturalized citizen) originally from India? This info looks like good for green card holders Thanks Comment from : Roger P |

|

|

Thanks a lot Mandar, This is exactly what I was looking for Comment from : vishal mane |

|

|

thank you for all your time and effort Comment from : Bhagwan Kripalani |

|

|

Can I Become Non resident after remitting money through LRS scheme in the same year Is it any non compliance of any law? Comment from : Lakshit Prajapat |

|

|

Thanks Comment from : UKnow |

|

|

very informative Comment from : madhukar goel |

|

|

Imensely helpful information and precise with exact points I have one question regarding inheritence, if I am the secondary holder on bank account (non-NRO) can these funds transfered with form-15CA and 15CB? aslo, does these funds in USA will face double taxation? Comment from : Anil G |

|

|

Very helpful, I am facing the same problem From Yangon Myanmar, Comment from : Dawood Meah |

|

|

Hi Subscribed channel, commented and liked the video Comment from : Anuja S Moharir |

|

|

Thank you for your presentationbrIs it allowed to remit money from India to Australia by a foreign national by sale of inherited property of India Need your opinion please Comment from : Qayyum mahbub |

|

|

If I transfer money from NRE account to US Bank account, do I need to declare or pay taxes in US? Comment from : Arunava Saha |

|

|

Can you suggest any app to transfer USD 10000 from India to USA Apps like Remiltry or Instarem or Rio Which is best and low transfer fees Comment from : K Dharmaraj |

|

|

Very informative and helpful Thanks! Comment from : rudy s |

|

|

Thank you for your help!! Comment from : Prashant Deshpande |

|

|

Hi mandar, very helpful info For examplebrIf my flat in india incurs no capital gain tax after indexation After bringing it back to us Do I have to pay tax here in US ? Pls help Comment from : Narayanan Gupta |

|

|

Any tax to be paid after transfer of money from India in US Comment from : Swarnalatha Vinjamuri |

|

|

Can you do a similar video on transferring something like a rent on a periodic basis (from NRO to account abroad of the same person) These are called current account transactions as opposed to capital gains transactions that you covered in this video Thanks Comment from : Path Kris |

|

|

Is there anyway to establish basis for how much was spent building a house Giving some hypothetical information here My dad would have spent about 40 lacs building a house 20 years back He is no more and the bank accounts used in these accounts have been closed long back How do I prove that this amount was spent in building the home to claim deduction from paying tax if I sell the property? There may be a way to get a current appraisal done, to come up with building cost now, but how do we determine the cost incurred 20 years back to prove to any government department as that seems to have a major impact on tax payable Comment from : Path Kris |

|

|

You have a Monalisa like mysterious smile on your face giving a feeling that you are not disclosing everything you might be knowing Comment from : My Music4U |

|

|

As usual Mandar has put in his great efforts here too Also please show some light how can Parents remit money to their earning children in the USA? There seems to be only available option "Maintenance of family members " I think it is valid till children were studying in USA Parents want to remit themselves as the children might find to get inherited funds later remitted difficulty Overall amount may be a few lacs of dollars Comment from : Jagdish Kumar |

|

|

Good information, but not full information As my unnderstanding goes, this limit of one million dollars not applicable when the assets sold is fully acquired by remittance from abroad or by paying out of NRE or NRFC accounts If you through CA prove that you had acquired the assets by overseas remittance or by debit to NRE account, the sale proceeds after payment of capital gain taxes can be remitted back without any limit Also one can freely remit back from NRE or FCNR account without any limit If one got balance in NRO account say by sale of inherited property, property acquired when he was resident, sale proceeds of shares or mutual funds acquired when he was resident etc can be remitted under one million scheme Comment from : Cyril DSouza |

|

|

Thank you for the information!!brWhat if the amount is $30k? we dont need to report at the time of filing? Comment from : Suwarna Deochake |

|

|

Thanks Mandar for the video How to bring our money earned in USA which i had transferred and accumulated in India in the form of Fixed deposit etc Plz suggest Comment from : Amit kumar shah |

|

|

What about transferring money from US to India for say giving EmIs for home or sending parents monthly etc Comment from : Neha Gupta |

|

|

Thank you for the information 👍 Comment from : Vijeyakumar Anthony |

|

|

I am in an exact situation as described and find this information very relevant Thank you!! Comment from : P V |

|

|

Thank you so much Comment from : basam nath |

|

|

Hope the Prediction works… Comment from : Senthil Kumar Murugesan |

|

|

What about taxes? Comment from : ramu vaasu |

|

|

Nice information Do we need to pay any tax on that money (let’s assume 100K) ? Comment from : heman Reddi |

|

|

It’s informative What about transfer from NRE bank account to USA bank account? Comment from : Ramadhar Mishra |

|

|

Thanks for the info Comment from : Sravana Desu |

|

|

very helpful can you also talk about how we bring provident fund money from india to US Comment from : Parag Dave |

|

|

V good video Finally some answers Comment from : Ruchi C |

|

|

Nice infothan doing Comment from : SUBBA RAO VALISETTY |

|

|

Good Info Mandar Comment from : sridhar k |

|

|

Thanks so much Comment from : Ambati Prashanth |

|

|

Very Helpful Video Comment from : Jaydeb Mukherjee |

|

|

Liked and subscribed Very useful info Comment from : Rajaram Srinivasan |

|

|

👌 Comment from : Sreeramsagar Pithani |

|

|

Subscribed and commented Comment from : Yashwanth Rao |

|

|

Wondering if money2India would work otherway, it would be good if it did(already subscribed and liked) Comment from : varun singh |

|

|

Subscribed & Liked 😉 Comment from : santhosh kumar Sallakonda |

|

|

Very good info! Comment from : Ram T |

|

|

Thank you so much Comment from : Veera Reddy |

|

|

Quite resourceful this video Need to keep legal things in mind while doing financial transactions Thanks for sharing Mandar Comment from : Rohan Prabhu |

|

|

Very helpful and to the point information ji, thank you!brRegards,brKamal Comment from : Kamal V |

|

|

Thanks Mandar! This is very useful Liked and subscribed 👍 Comment from : Harish Chegondi |

|

|

🤗 Comment from : A S |

|

|

Very useful information, also subscribed & liked 👍 😀 Comment from : Raman Kumar |

|

|

Thanks for the informative video! 👍🏻 Comment from : Pratik Pai |

|

|

Liked and subscribed Comment from : JS |

|

|

Mandar, appreciate this video What about taking money out of NRE back to US how would interest earned in the NRE accounts be handled?brbrThanks again for this informative video Comment from : Pankil Shah |

|

|

This is extremely helpful Thanks a ton! Comment from : Vibush Ramadas |

|

|

Please do USA to Canada for h1b Comment from : A S |

|

|

This is useful info Thanks for this video Comment from : Saravanan Sekar |

|

|

Liked and Subscribed! 👍 Comment from : Crictonomy |

|

|

I watched this vediobut I felt my conditions are different Would like a solution tailored for my situation Want to know the tax implications, when I take the us citizenship Comment from : UshaSrinivasan |

|

|

Subscribed and liked Comment from : UshaSrinivasan |

|

|

Subscribed and liked Very informative 👏 Comment from : eshwar c |

|

|

Thanks for providing informative information on this topic brSubscribed, liked and commented Comment from : Harish Narayanappa |

|

|

Sir, Very good video, and very well explained Comment from : Sarma Malladi |

|

|

Subscribed and Liked Comment from : Faiyaz Ahmed |

|

|

Good one Comment from : Vini Vini |

|

|

This is helpful Comment from : uhemanth |

|

|

Thanks , well explained Comment from : Vemareddy Sai Kishore |

|

|

Very informative video thanks Comment from : Ilyas S |

|

|

Commented Comment from : Kahaan Desai |

|

|

If your father or mother Send money Is that taxed as well Comment from : Haris Hafeezjan |

|

|

Thanks Mandar for sharing this information was very helpful One quick question After I declare the transfer of funds with IRS in US is there any tax deducted for this transferred amount in USD? Comment from : Priyal Chitre |

|

|

Thank you Mandar for sharing this! Comment from : Amey Paranjape |

|

|

Good one Comment from : Satya Gopaluni |

|

|

Subscribed and liked! Comment from : raichurbabu |

|

|

Also i have subscribed your channel for immigration updates In fact, i wait for your video which is coming after visa bulletin release Thanks much Comment from : raichurbabu |

|

|

Hello sir, this information is very helpful I was looking for this information for a while Now i feel good and comfortable Thanks much for all your support and guidance Comment from : raichurbabu |

|

|

subscribed and liked Comment from : Dedeepu Kalva |

|

|

Had many questions about this topic Thanks for clarifying them Comment from : Sheru |

|

|

Suscribed & liked Comment from : Vivek Jain |

|

|

Very good information This was good for lot of friends Comment from : Ray K |

|

|

Subscribed Comment from : Ray K |

|

|

Very informative 👌 Comment from : Abhishek Kumar |

|

Repatriation of funds from India to USA: How it works РѕС‚ : SBNRI: One Stop Platform for NRIs Download Full Episodes | The Most Watched videos of all time |

|

What is the process of repatriation from India to UK? РѕС‚ : SBNRI: One Stop Platform for NRIs Download Full Episodes | The Most Watched videos of all time |

|

Top 10 Countries From Which USA has Burrowed | 30 Trillion USA Debt | USA Debt Ceiling | Japan Debt РѕС‚ : Engineer Shrestha Download Full Episodes | The Most Watched videos of all time |

|

Remitly Vs Ria Money Transfer || 2 Best ways to send money from USA to India in Telugu || MS in USA РѕС‚ : Revathi Jannavarapu Download Full Episodes | The Most Watched videos of all time |

|

Repatriation Scheme For NRIs - 1 Million Dollar Scheme - By CA Sriram РѕС‚ : NRI Money Clinic Download Full Episodes | The Most Watched videos of all time |

|

Should NRIs Pay 20% Tax On Repatriation Post 1st July 2023 ? - A Must Watch Episode For All NRIs РѕС‚ : NRI Money Clinic Download Full Episodes | The Most Watched videos of all time |

|

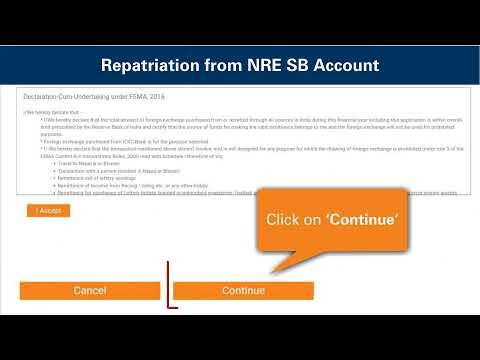

NRI Internet Banking: Repatriation from NRO/NRE SB Account Demo РѕС‚ : ICICI Bank Download Full Episodes | The Most Watched videos of all time |

|

NRI Demo for repatriation from NRO Account РѕС‚ : ICICI Bank Download Full Episodes | The Most Watched videos of all time |

|

How GOLD is Moved Around the World | Gold Repatriation | How to Keep Gold Safe | ENDEVR Explains РѕС‚ : ENDEVR Download Full Episodes | The Most Watched videos of all time |

|

Top 10 EXTREMELY Valuable Items You May Own (Rare Items You Might Own) РѕС‚ : Nexus Download Full Episodes | The Most Watched videos of all time |