| Title | : | Annuities - How To Calculate The Future Value of an Annuity Due |

| Lasting | : | 12.17 |

| Date of publication | : | |

| Views | : | 67 rb |

|

|

Premium Content: wwwpatreoncom/VideoInvestor Comment from : The Organic Chemistry Tutor |

|

|

Thank you so much Comment from : eunice ntinyari |

|

|

I think this should be ordinary annuity Bcz here mention end of each year Comment from : Dilshani Iresha |

|

|

second question says end of the year so it is ordinary annuity how can you solve this from annuity due formula? Comment from : Iqra Malik |

|

|

how do you know that the second problem is annuity due? Comment from : RinKaShiMe028 |

|

|

This just helped me with my ECO 304(Money & banking) homework thanks a lotbrbrBusiness & Eco students unite Comment from : The Nameless Demi-God |

|

|

I'd like to know how much money I'd have out of $800000 after paying taxes, when I transfer all the money on my checking account Comment from : Simon Greenshpan |

|

|

The questions wording is mixed upthe formula application in an Ordinary annuity and annuity due looks mixed up as well Comment from : levin nashon |

|

|

the answer should be 59754 Comment from : Sylvie Lombi |

|

|

i think you made a mistake in the equation, it's 100 not 1200 Comment from : Sylvie Lombi |

|

|

A company wants to provide a retirement plan for the marketing manager who is aged 55

brnow The plan will provide the manager with an annuity of GHS7,000 at the end of every

bryear for 15 years upon his retirement at the age of 65 years The company is funding this plan

brwith an annuity at the beginning of the year for 10 years If the rate of effective interest is

br5, what is the amount of installment the company should pay? Comment from : Emmanuel Opoku |

|

|

In The second example payment was going to be made at the end of a time period meaning it’s supposed to be an ordinary annuity so why did you you the formula for annuity due ? brbrPlease explain Comment from : Andrew Junior Okanta |

|

|

Is this the same as general annuity? Comment from : Ted Mint |

|

|

I think the right answer should be $6,94858 It should be an ordinary annuity, not annuity due since it's at the end of the year payment Comment from : NatsM |

|

|

Nominal annual rate Comment from : 4ckng potato |

|

|

Sir I don't think it is right the way you do to the cashflow 100×12 nah I think you will just take 100 Prove me wrong because I have the book if I try to multiply 12 of the months The answer of the book and my answer will not be same but when I just take 100 it is right answer according to the book Comment from : siyaa languages |

|

|

Problem no 1 is not an annuity due problem since it's not in the begginning of the year Comment from : John Llasaf |

|

|

You are now my math tutor Congratulations lol Comment from : wata_ drag |

|

|

I just wanna know ,what did you study ? Cause how??😂 plug for everything Thank you Comment from : Natasha Chileshe |

|

|

problem #1 just saysbrbrpayment is each monthbrbut didn't tell if it is to be paid at the beginning or endbrbrwhy do we use annuity due formula? Comment from : TUTS TORIAL |

|

Time Value of Money Finance - TVM Formulas u0026 Calculations - Annuities, Present Value, Future Value РѕС‚ : Subjectmoney Download Full Episodes | The Most Watched videos of all time |

|

How to Calculate Future value | Single Cash Flow u0026 Annuity | CVF | Time Value of Money | Finance РѕС‚ : Ankit Finance Club Download Full Episodes | The Most Watched videos of all time |

|

How To Calculate The Future Value of an Ordinary Annuity РѕС‚ : The Organic Chemistry Tutor Download Full Episodes | The Most Watched videos of all time |

|

Monthly Guaranteed Income in SBI | SBI Annuity Deposit Scheme 2022 | SBI Annuity Scheme |Josh Money РѕС‚ : जोश Money Download Full Episodes | The Most Watched videos of all time |

|

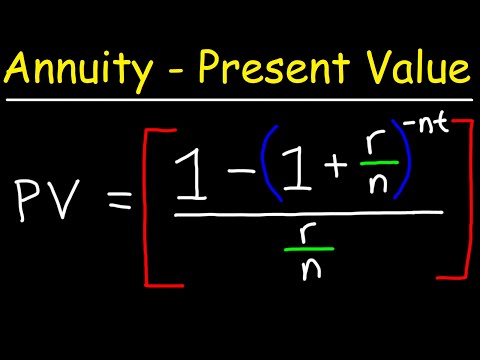

How To Calculate The Present Value of an Annuity РѕС‚ : The Organic Chemistry Tutor Download Full Episodes | The Most Watched videos of all time |

|

Present Value u0026 Future Value| How to calculate PV u0026 FV| Time value of money| PVF Table and CVF Table РѕС‚ : GYANVI KI PATHSHALA Download Full Episodes | The Most Watched videos of all time |

|

Future Value of an Ordinary Annuity | HP 10bII+ Financial Calculator РѕС‚ : Counttuts Download Full Episodes | The Most Watched videos of all time |

|

Future value of annuity with Calculator РѕС‚ : Kumar u0026 brother Download Full Episodes | The Most Watched videos of all time |

|

Future Value of an Annuity РѕС‚ : Edspira Download Full Episodes | The Most Watched videos of all time |

|

Garena DDTank:Combo 2000 Tốc Độ Sẽ Kinh Khủng Như Thế Nào?Best Cướp Turn Cân Team Lật Kèo РѕС‚ : Review Game N.B.H Download Full Episodes | The Most Watched videos of all time |