| Title | : | Small Business Taxes Canada | CPA Explains How Small Business Taxes Work in Canada |

| Lasting | : | 11.03 |

| Date of publication | : | |

| Views | : | 31 rb |

|

|

12 times is relatable my friend! Comment from : MYRDEN |

|

|

Great video very helpful Comment from : Johnny Pare |

|

|

What accounting software is the best/cost effective to keep track of the expenses? Thanks Comment from : Anna |

|

|

I'd love to have a consultation with an accountant regarding this very subject, I am currently an employee but am considering opening a small business simply to have a tax shelter and create a very small amount of income on the side Where would one go to find such an accountant? Comment from : Rothaarige |

|

|

I wish this was dumbed down a bit I feel so hopeless knowing this is useful information to which I just do not understand at all Comment from : VinceVideo |

|

|

Ty Comment from : MTTM Media |

|

|

Hey I'm from India, i tech studentsbrCan you explain all accounting software and all business tax like aa GST tax Comment from : Accounts Solution |

|

|

I like your video presentation It is informative too, at the same time Thanks a lot for your guidance! Comment from : Aryana Smith |

|

|

No it doesn't make sense Go on Comment from : Perry Wolfgang |

|

|

Can you talk more on Life insurance and holding company strategies for small builders owners Comment from : 11511mido |

|

|

A bunch of BS Comment from : Marius Ruicea |

|

|

Good morning, so please help me here to understand If I am sole proprietorship Alberta the same rules applies? Comment from : Luciana de Lourdes |

|

|

Perfect! Right now I am building wealth using RRSP, but now that I am buying rental property I am thinking about advantages of creating a Corporation (I am in a high bracket) so, wondering if we can have a phone consultation? Comment from : claudia |

|

|

I work full time and paid salary and looking to start a sole proprietorship small business to start with for couple years If I spend $30,000 in equipment for the business, how do I claim this expense towards my income tax and what's the tax percentage CRA takes? Comment from : Sam Job |

|

|

Hi there, I am looking to get into consulting business for corporate sales with big commissions contract No salaries straight up commission ranging from 500K to 2 Millions + CAD what is the best structure to minimize the tax burden? Any suggestions will be greatly appreciated! Thank you Comment from : Momo |

|

|

Can you help me I am so lost I want to register my company but I am the only person working Aren't I getting screwed over? because I will have to pay the tax twice? I do not want to give myself a "salary" per say, my income would be literally everything the company gets, Maybe I will spend it on stuff for the company, maybe I will save it for the next year, maybe I will buy food with the money Its so confusing Do I "become" the company and only have to do the 1 income tax at the lower rate? or do I have to do both? And if I have to do both, can I just say I am "not working" and just spend freely whatever the company makes? And if I can't do that, it kinda feels like the company is actually property of the government if I can't do what I want with the company $ Comment from : MUSLIM COSMETICS |

|

|

Hi How are you? what percentage of buyer gives ratings on amazon Comment from : Bindas |

|

|

Thanks Comment from : Spinward Bound |

|

|

Thank you! Comment from : Allpixelated Outdoors |

|

|

how much do you charge for corporate filing tax Comment from : LJ Canada |

|

|

Amazing video Been searching for this for a while Thank you Comment from : Agrahara Recipes |

|

|

Hello, thank you for the video That was very helpful One question - to qualify for the small business tax deduction (lower corporate tax rate), we need to earn less than $500,000 on our first income Just to clarify, this is per year and not lifetime aggregate, correct? So every year we can qualify and claim the small business deduction as long as our income every year stays under $500,000 and we are Canadian owned company? That is of course in case law doesn't change Thank you Comment from : Torontoaccount1234 |

|

|

So could someone just file their small business taxes as a normal income even without a T4 slip, but keeping all of the invoices and receipts for expenses for proof incase the CRA asks for it? Comment from : Aubatron |

|

|

Good video You didn't really mention Corporately held Whole Life Insurance or Individual Pension Plans Curious about your thoughts on those two strategies? Comment from : Aaron Wealth Management |

|

|

Keep making videos! Comment from : Max Ivy |

|

|

If you have your own professional corporation but also have another job where you are paid as an employee, can you keep all your earnings from your professional corporation in the corporate bank account and not pay yourself a salary or dividends? Comment from : Belle and Prav Grewal |

|

|

Thank You!! Best explanation of personal & corporate tax EVER! Comment from : Claire Wallace |

|

|

Your channel is very helpful to my husband and myself right now I'm learning alot from your videos about pro and cons about incorporating Thanks so much Comment from : Seu Sibaran |

|

|

Many thanks :-) Comment from : saad elmansori |

|

|

Good tips! Thank you! I'm wondering about the extras beyond RRSP's You kinda hinted at insurance policies What are your thoughts on IRP (insured retirement plans) for corporations? Comment from : cory goodwin |

|

|

Great video Joe! I have a question: For someone who is working for an employer and paying personal income taxes and wants to start a home based business what are the steps to get it going? It feels very complicated Comment from : Original RnD |

|

|

Very impressive Good work Joe Comment from : Doug Collins |

|

Taxes in Canada 2021, How high are taxes in Canada | How to save some Tax Money in Canada. РѕС‚ : Gursahib Singh - Canada Download Full Episodes | The Most Watched videos of all time |

|

How Canadians Can Pay ZERO Taxes Legally! Canada Taxes and Canada Tax Residency Explained РѕС‚ : Wealthy Expat Download Full Episodes | The Most Watched videos of all time |

|

?? Top 5 Small Business Ideas in Canada 2023 | Profitable Business Ideas for Canada 2022-2023 РѕС‚ : 5 Ideas Download Full Episodes | The Most Watched videos of all time |

![Accounting Basics for Small Business Owners [By a CPA]](https://i.ytimg.com/vi/3KeG7hHzUy4/hqdefault.jpg) |

Accounting Basics for Small Business Owners [By a CPA] РѕС‚ : LYFE Accounting Download Full Episodes | The Most Watched videos of all time |

|

Gross Income Vs Net Income| CPA Explains What to Look For in Both РѕС‚ : LYFE Accounting Download Full Episodes | The Most Watched videos of all time |

|

Can I go to jail for owing back taxes | New York City CPA РѕС‚ : Anil Melwani, NYC Tax Expert Download Full Episodes | The Most Watched videos of all time |

|

TAX EXPERT EXPLAINS Top 5 Tax Write-Offs for Small Businesses in Canada for 2022 РѕС‚ : Gabrielle Talks Money Download Full Episodes | The Most Watched videos of all time |

|

FIRST JOB IN CANADA || SALARY IN CANADA || DAYCARE TEACHER IN CANADA || FILIPINA LIFE IN CANADA РѕС‚ : Ingrid Fraser Download Full Episodes | The Most Watched videos of all time |

|

Top 10 High Profitable Business Ideas For 2023 || New Business Ideas || Small Business Ideas РѕС‚ : study tips Download Full Episodes | The Most Watched videos of all time |

|

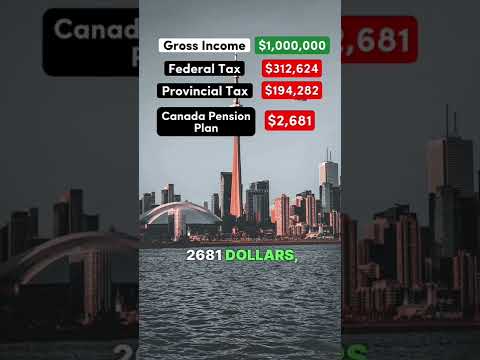

$1 Million Salary After Taxes in Ontario, Canada #ontario #canada #democrat #republican #salary РѕС‚ : The Next Gen Business Download Full Episodes | The Most Watched videos of all time |